The Nigerian stock market has returned a whopping 43% year to date making it one of the best performing stock markets in the world this year.

This year’s performance contrasts sharply with 2019 when stocks closed negatively at 14.9% and it is on track to beat 2017 returns of 42.3%. The stock market turnaround began right during the lockdown but took off in late August as new monies from matured treasury bills and Omo auctions flowed into the economy. According to information from Nairalytics research, about 57 stocks posted year-to-date gains at Christmas, a figure that is likely to touch 60 stocks by the end of the year. About 65 stocks currently post year to date losses.

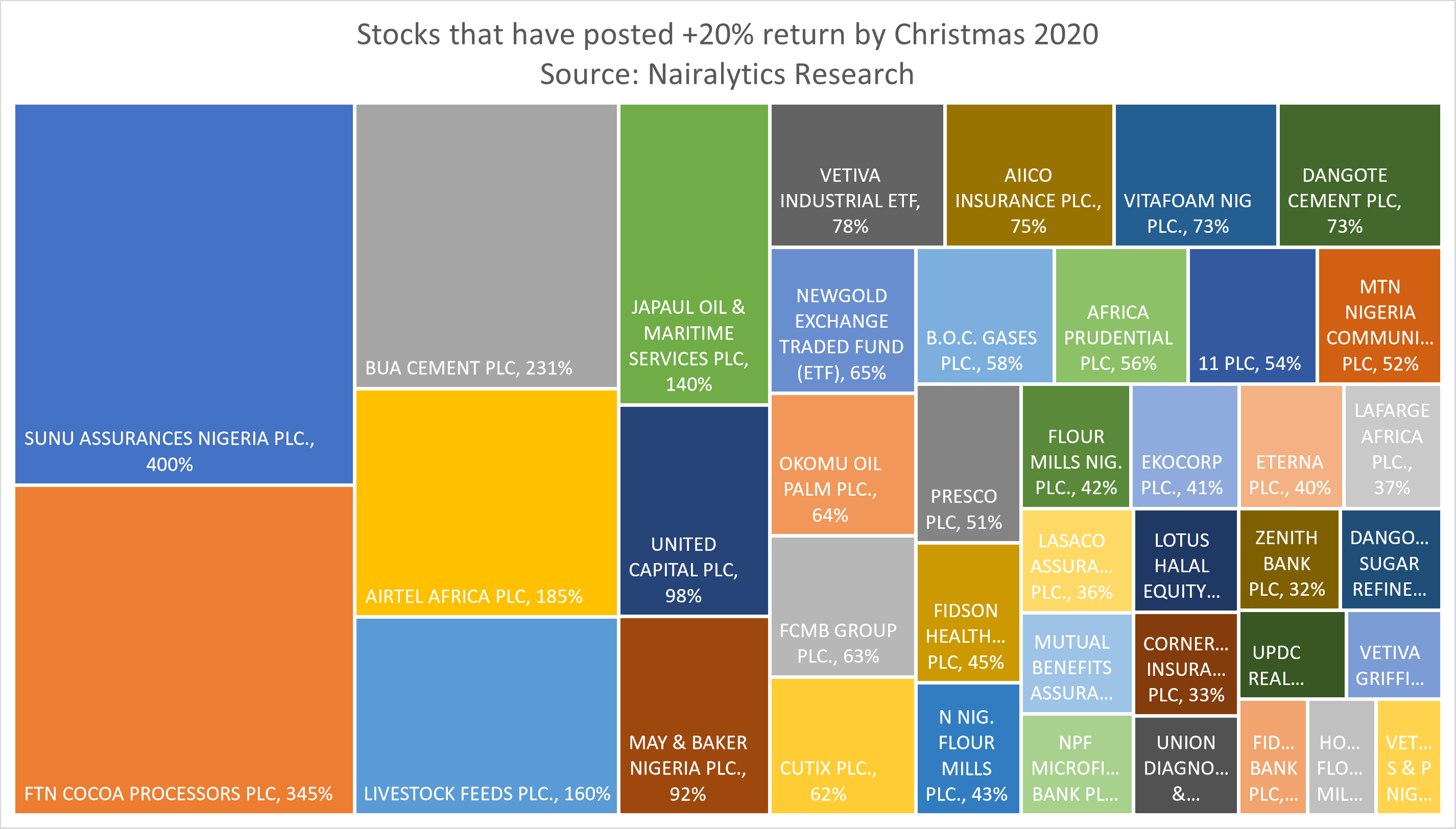

Considering how beautiful the year has been for most stocks, Nairalytics data also reveal about 21 stocks have gained above 50% this year. See snapshot Further breakdown

Above 20% – 40 stocks

Above 30% – 34 stocks

Above 50% – 21 stocks

Above 100% – 6 stocks

Above 200% – 3 stocks

Above 300% – 2 stocks

Above 400% – 1 stocks.

Top 5 stocks in ascending order Livestock Feeds – The Agro-allied company has had an amazing 2020 aided by the government’s support for the Agriculture sector and the border closure. Nigerian farmers may not be happy with the price of feeds but company’s like Livestock have reaped the benefit of higher prices and scarcity. Current share price : N1.3 Opening 2020: N0.50 Year high: N1.52 Year low: N0.46 YTD return: 160% Current earnings per share: N0.749 Airtel Africa – The telecoms giant has had a stupendous 2020 riding on the thirst for data amidst the Covid-19 lockdown. Its revenue rose 16.4% to $1.8 billion while EBITDA also rose 19.3% in the first half of the year respectively. The stock has also attracted the attention of foreign investors who have taken advantage of its duel listing to take dollars out of the country. Current share price : N851.8 Opening 2020: N298.9 Year high: N851.8 Year low: N298.90 YTD return: 185% Current earnings per share: $3.0 BUA Cement – The cement conglomerate has had a very busy 2020 where the fruit of its 2019 merger was expected to be fully operational. Some may attribute its share price increase to several factors including the usual Forbes effect. However, N59.3 billion posted in the first 9- month of this year as pre-tax profits is higher than […]