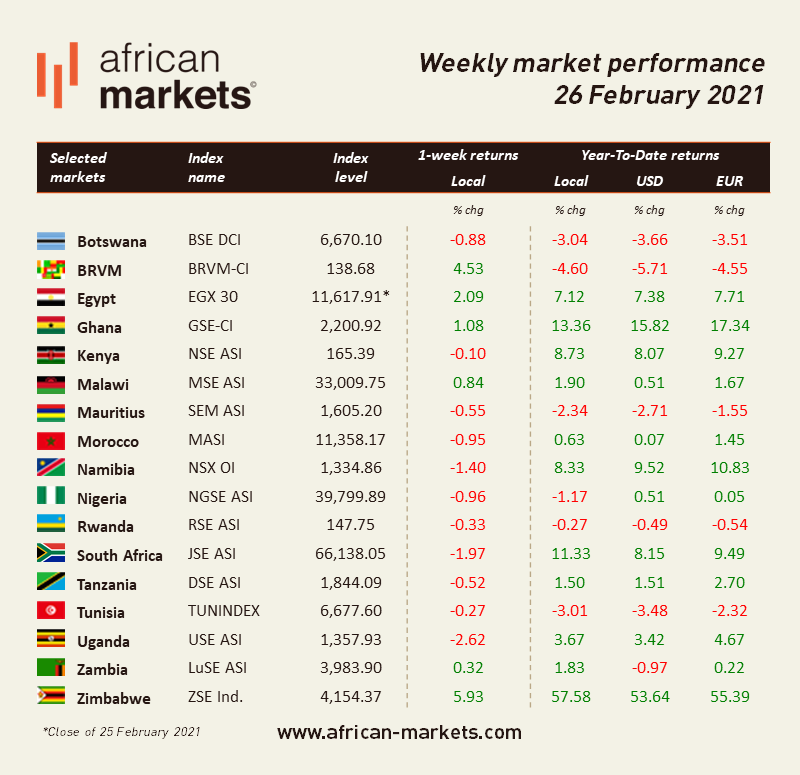

Overall sentiment on African equity markets was bearish. Among the markets we cover, 11 of them retreated this week and 6 advanced. Zimbabwe led the pack as equities in Harare rallied 5.93%. Conversely, Ugandan equities lost 2.62% over the 5-day period.

West Africa

BRVM – Bulls were back on the Western Africa regional exchange. The Composite Index rallied 4.53% in a thinly traded week that saw only XOF 255m (USD 0.47m) worth of shares change hands every day on average. This is 20% lower than the daily average turnover of the week before. The market is now down 4.60% year-to-date and the total market capitalization stands at XOF 4,173bn (USD 7.7bn). The top performer this week is Nestle Côte d’Ivoire . The stock jumped 17.50% over the 5-day period and is now up 120% since the beginning of the year. The market heavyweight, Sonatel , closed the week at XOF 12,775, up 13% over the week. Shares in the telecom operator are down 5.37% year-to-date.

NGSE – Bearish sentiment prevailed in Lagos as stocks plunged for the fourth week in a row. The ASI closed on Friday below 40,000 pts at 39,799.89, down 0.96% WoW. YTD returns moved further in negative territory in local currency (-1.17%). The improving yield environment in the fixed income space remained the main driver of the performance (or lack thereof) in equities. A daily average of NGN 3.2bn (USD 8.5m) worth of shares was traded over the last five days. The total market capitalization stands at NGN 20.8tn (USD 54.6bn). The top performer this week is LASACO Assurance Plc . Shares in the insurer jumped 193% but this is mainly due to the finalisation of the Share Reconstruction operation. A Share Reconstruction otherwise known as reverse stock split is just a way of technically reducing the number of outstanding shares and increasing share price without affecting market value. In January, LASACO Assurance Plc obtained regulatory approval to reverse stock split in the ratio one (1) new ordinary shares for every four (4) ordinary shares previously held by its shareholders. Dangote Cement , on the other hand, remained flat and closed the week at NGN 220. The shares in the cement producers are down 10.17% YTD.

North Africa

BVC – Morrocan equities declined for another week. The MASI shed 0.95% in a week that saw MAD 93.95m (USD 10.5m) worth of shares changed […]