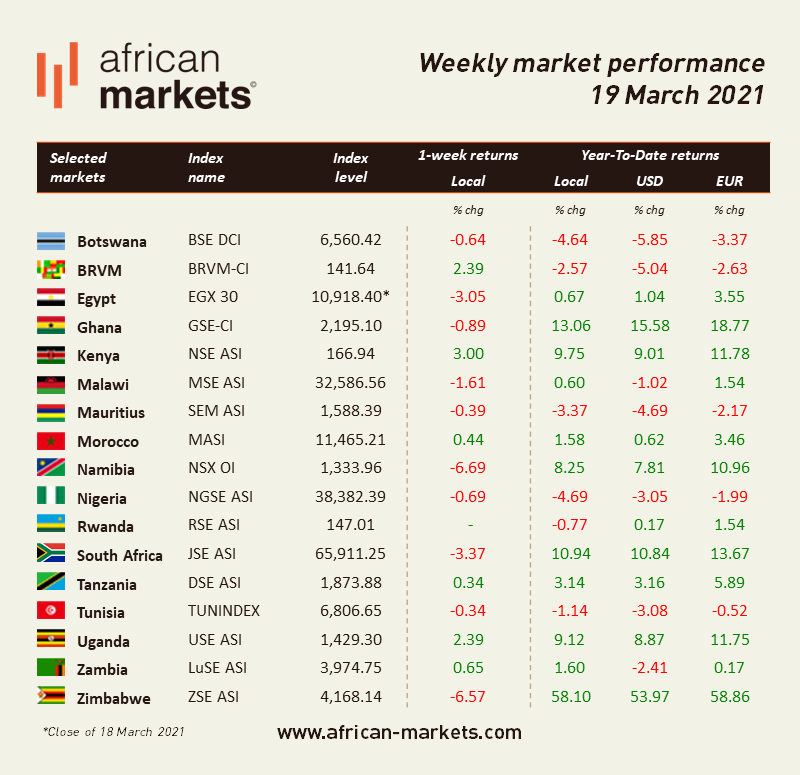

Overall sentiment on African equity markets was bearish. Among the markets we cover, 10 of them retreated this week – some of them, severely – while 6 advanced and one remained flat. Kenya led the pack as equities in Nairobi jumped 3% and are up 9.75% so far this year. Conversely, Namibian equities lost 6.69% over the 5-day period but remain up 8.25% YTD.

West Africa

BRVM – Bulls set the tempo on the Western Africa regional exchange pushing the benchmark index up during all five sessions of the week. Overall, the Composite Index gained 2.39% to break the 140 points mark in a thinly traded week that saw only XOF 139m (USD 0.25m) worth of shares change hands every day on average. This is about half of the already low daily average turnover seen the week before. The market is now down 2.57% year-to-date and the total market capitalization stands at XOF 4,264bn (USD 7.7bn). SAPH – Société Africaine de Plantations d’Hévéas is the top performer this week. The stock of the rubber producer jumped 16.55% over the 5-day period and is up 80% since the start of the year. The market heavyweight, Sonatel , closed the week at XOF 13,000, up 6.56% over the week. Shares in the telecom operator are down 3.70% year-to-date.

NGSE – Bears maintained their hold on equities in Lagos. The benchmark index of the Nigerian stock exchange declined for the seventh-straight week closing on Friday at 38,648.48, down 0.69% WoW. YTD returns moved further into negative territory in local currency (-4.69%). Rising yields in the fixed income space continued to weigh on investor sentiment. Activity remained strong this week as NGN 3.9bn (USD 10.13m) worth of shares was traded on average over the last five days. The total market capitalization stands at NGN 20.1tn (USD 52.8bn). The top performer this week is Eterna . Shares in the petrochemical company jumped 20.78% and are now up 9.41% YTD. Dangote Cement , on the other hand, remained flat at NGN 220. The shares in the cement producers are down 10.17% YTD.

North Africa

BVC – Morrocan equities advanced this week. The MASI gained 0.57% in a week that saw MAD 126.9m (USD 14.1m) worth of shares change hands every day on average, a 70% increase from the week before. Total market capitalization stands at MAD 594bn (USD 66.1bn), up 1.58% YTD. Managem […]