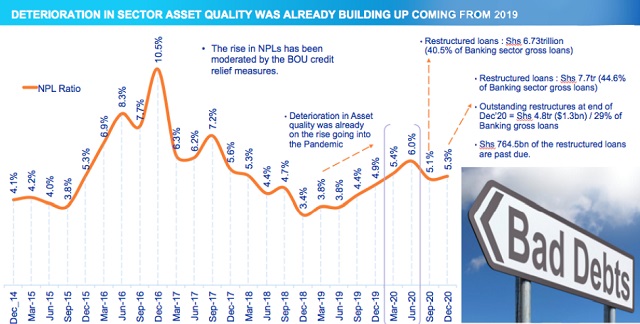

Commodity, tourism dependent economies likely to remain vulnerable over the next 12-18 months | THE INDEPENDENT | Uganda’s commercial banks have recorded a sharp drop in the outstanding restructured loans from Shs7.7trillion in June to Shs4.8trillion in Dec, 2020, signaling improvement in the borrower’s ability to meet their loan obligations, according to Stanbic Bank Chief Executive Anne Juuko.

Juuko, who was speaking to a section of the bank investors and media on March 19 in Kampala ahead of the lender’s release of financial results for 2020 on March.30, said another Shs764.5bn of the restructured loans are past due.

However, she said business in the banking sector is slowly recovering albeit at a slower pace owed to the coronavirus pandemic.

“Bank of Uganda projections show that the economy will grow by 3-3.5% in 2021 and 6% to 10% by 2023. This will be as a direct result of the rollout of Covid-19 vaccines; implementation of the African Continental Free Trade Agreement (AfCTFA); an expected rebound in tourism; improvement in global investment and the continued recovery in exports due to a revived strength in foreign demand,” Juuko explained.

However, on a cautionary note, she noted that commodity and tourism dependent economies remains vulnerable over the next 12 to 18 months.

This development comes barely a month since the Bank of Uganda extended the bank’s Credit Relief Measures for another six months to help commercial banks and other supervised financial institutions to continue restructuring loans and also provide loans to the commercial banks and financial institutions to lend out to the business community.

Samuel Mwogeza, the chief financial officer at Stanbic Bank said the country’s private sector credit is expected to grow rapidly.

He said the Stanbic Purchase Managers Index (PMI) had dropped to record lows in April 2020, but regained momentum in the second half of the year, crossing back to the 50 area in February 2021 as employment increased for the first time in three months, after the elections and a wider reopening of schools.

“There is renewed optimism and a pickup of business activities. This ended a two-month sequence of job cuts and a subsequent increase in staffing and employment levels,” he said.

Mwogeza said agriculture, manufacturing, utilities and transport sectors registered growth signaling commercial banks’ appetite to provide financial support.

He, however, said trade sector was hit by disruptions in access to both working capital and bottlenecks in imports and export processes.“Small and medium enterprises were the most […]