For six months, Kenyan banks have been like Atlas- the god in Greek mythology who carried the world on his shoulders.

They have strenuously held aloft an ailing economy, forestalling what would otherwise have been a financial meltdown.

But now, just as the late American writer Ayn Rand put it that “Atlas shrugged,” banks too have started buckling under the weight of a flaccid economy.

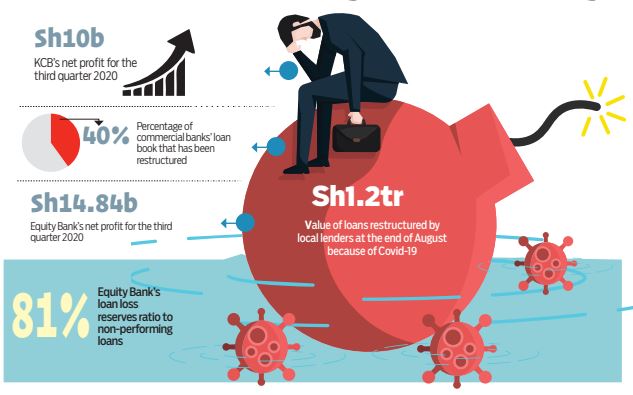

Profits are plummeting. Return on equity – the percentage of what shareholders receive for every shilling they have invested – has shrunk by over a third. Read More

Equity Bank, NCBA and Standard Chartered recalled their dividends for the financial year ending 2019. KCB Bank for its part cancelled its interim dividends in the first half of the year.

The average share price of select Kenyan banks has fallen 31.6 per cent year-to-date as of October 27 compared to a drop of eight per cent for the rest of frontier banks’ universe, according to a study by EFG Hermes, an investment bank.

As a result, Kenyan banks’ price-to-book (p/b) ratio, which is used to compare a firm’s market capitalisation at the stock market to its book value, dropped to a historic low 0.7, meaning the stocks are trading for less than the value of their assets.

This is in contrast to an average p/b ratio of 1.4 in the 2014 financial year to 2019.

But it is not just shareholders’ earnings that are being sacrificed, employees too are being offloaded as banks seek to stay afloat through financial turbulence that is expected to carry on into the next year.

Standard Chartered is reported to have put some 200 employees on the chopping board.

NCBA, the third-largest bank by market size, has also communicated to its employees that it will be laying off an unspecified number of employees by the end of the year.Reorganising NCBA’s workforce, the bank’s Managing Director John Gachora noted, is meant to protect the future of the company.He said while it was the intention of the bank to retain all staff from the combined entities of NIC and CBA, this has been disrupted by the pandemic.“We have had to defer our plans to scale our branch network and have taken unprecedented steps to support our customers in weathering this storm through loan moratoriums and fee waivers,” said Mr Gachora.He noted that the recovery from the blow of the pandemic, which has seen millions lose jobs, will be slow.“There are […]