Lipa na Mpesa The mobile money war in Kenya is not a new thing: the space has for a long time been cannibalized by M-PESA, which started the service back in 2007.

Over the years, it has amassed millions of numbers, with more than 34 million Kenyans having an M-PESA account.

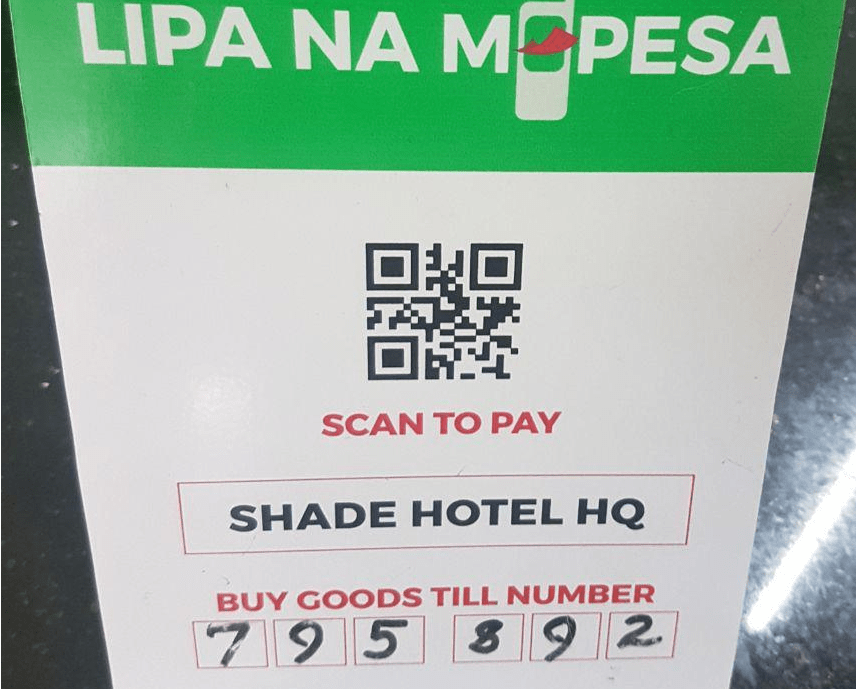

M-PESA has also grown so much that it is one of Safaricom’s leading profit-makers. Its other services, including Lipa na M-PESA that was introduced in 2013, as well as the overdraft facility Fuliza have seen the platform make notable financial gains, more than the competition, and by far.

These developments can be associated to the carrier’s innovative team. To this end, M-PESA and its associated services are guarded by Safaricom by such a large extent that integration with rival products is nearly unheard of, save for very few applications.

M-PESA’s reach has also been fought by competing products. T-Kash and Airtel Money have basically 1 percent of market share, and M-PESA takes the rest. This, according to experts, is uncompetitive, and Safaricom has insisted for a long time that it should not be punished by regulators because of its success.

Some developments have been made though. Interoperability is here, meaning customers can send or receive cash to their other mobile money wallets from M-PESA. Also, some banks allow customers to make bill payments from those accounts to M-PESA tills/pay numbers. Equity Bank has a similar product known as One Equity number, which allows merchants to receive payments from customers using M-PESA, Airtel Money and PesaLink, to mention a few.

However, Airtel Money customers, or even T-Kash users cannot make bill payments to M-PESA till, and this has traditionally been the case.

Nonetheless, the CBK wants to change this through the introduction of a national payments system that will compel Safaricom to accept money from other similar products on its Lipa na M-PESA platform. This was first reported by Business Daily .

This is timely because, and as said, M-PESA owns the mobile money space, and the majority of businesses use tills and pay bill numbers offered by Safaricom.

It, therefore, makes more sense why the Lipa na M-PESA infrastructure should be interoperable, or so, the CBK thinks.

“The emergence of a fully integrated ecosystem that is seamlessly interoperable is critical. A strong foundation has already been laid with the rollout of P2P [peer-to-peer] interoperability in 2018 and the industry engagement that culminated in the proposal for a single […]