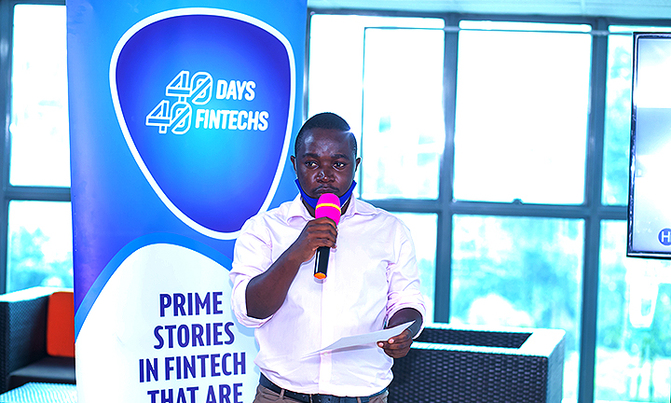

Slated for December 11 in Kampala, winners will be crowned at the #IncludeEveryone – Digital and Financial Inclusion Summit and gala. HiPipo chief operations officer Nicholas Kalungi FINTECH

KAMPALA – Individuals and organisations spearheading the use of digital tools to serve their communities better and enhance financial and digital inclusion across Africa are to be recognized at the 2020 Digital Impact Awards Africa (DIAA).

This follows the completion of the submission and validation exercise that took place between October 19 and November 10, 2020, under 36 categories.

Slated for December 11 in Kampala, winners will be crowned at the #IncludeEveryone – Digital and Financial Inclusion Summit and gala.

To be held under the theme "collaboration to advance safety and security towards sustainable financial inclusion" the summit will explore the strategic trends and technologies that are shaping the future of digital, information technology and business.

Organised by HiPipo, DIAA is a platform that promotes Digital Inclusion, Financial Inclusion and Cyber Security. It is now in its seventh year.

Commenting about the annual awards, the HiPipo chief operations officer Nicholas Kalungi said; "The #DIAA2020 edition comes in the middle of the COVID-19 pandemic; an unprecedented period that has, on one hand, wreaked socio-economic havoc across the world, but on the other hand further showcased the life- serving and saving capacity of digital-financial services."

Of the 36 categories, 17 will recognise best performing digital and financial players from across Africa while 19 are purely focused on Uganda.

There are also two special recognitions; Regulatory Financial Inclusion Rails Award and Women in FinTech Leadership Award.

The Regulatory Financial Inclusion Rails Award recognises initiatives, programs and projects that are aimed at setting up the needed financial inclusion infrastructure rails with key emphasis on instant payments platforms in Africa.

According to Kalungi, regulators are key enablers of financial inclusion as they provide a favourable legal framework, lead the provision of a national digital identity to all residents and the development of real-time payment systems.The Women in FinTech Leadership Award on the other hand seeks to recognise and appreciate a woman that is taking lead in bridging the gender diversity challenge in the financial technology space."Just like most countries especially in Africa, Uganda still struggles with a huge gender diversity challenge in the financial technology space. Only 10% of the 41 Fintechs that took part in the 2020 40-Days-40 Fintechs initiative had either women co-founders or women in their senior management."The limited involvement of Women […]