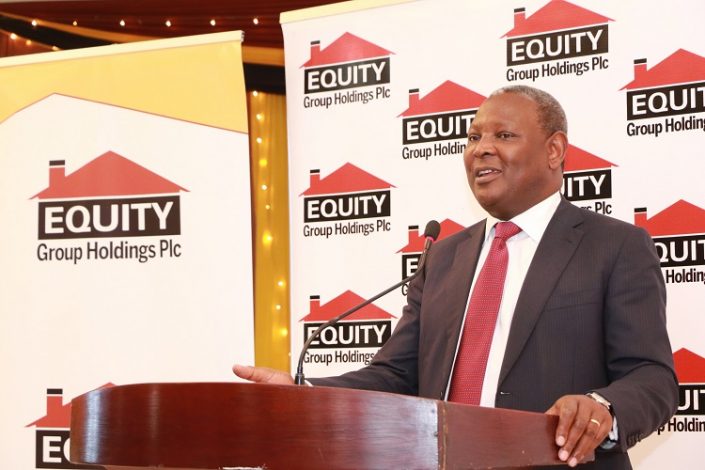

Kenyan Banks have been listed on Africa’s top 100 top 100 banks by tier 1 capital conducted by the Africa Business Magazine. Equity was the highest ranked Kenyan bank in the report.

The bank climbed three places to position 24 following a 27% increase in its capital to Ksh. 157 billion ($1.4 billion) in the 2021 Q3 financial results. The Africa Business Magazine noted Equity’s continued expansion in the regional market including the recent foray into the Democratic Republic of Congo (DRC). This is with the merger of Equity Bank Congo (EBC) and Banque Commerciale du Congo (BCDC) to form Equity BCDC .

Commercial Bank of Ethiopia (CBE) and Kenya’s KCB dropped places in this year’s ranking to positions 26 and 29 respectively.

KCB also slipped from position 25 to 29 with tier 1 capital down 6% to Ksh. 123 billion ($1.1 billion), a drop attributed to an 8% depreciation in the Kenyan Shilling against the US Dollar.

Although regional economies have been hard hit, the report has recognized Kenya’s and the region’s accommodative monetary policies as part of the emergency response by policy makers and central banks. The banking industry is expected to recover later in the year, with Kenya bouncing back fastest.

Overall, Kenyan banks make up regional rankings positions 4 to 7. Tanzania’s highest ranked bank is the National Microfinance Bank, creeping up the overall ranking from position 67 to 64 and position 8 in the region with a capital of Ksh. 44.6 billion ($397 million). Rwanda’s Bank of Kigali is back in the top 100, after dropping out last year, although tier 1 capital fell 1% to Ksh. 25 billion ($224 million).

Equity’s rise in ranking comes in the backdrop of economic turbulence in the region occasioned by the ongoing COVID-19 pandemic. The bank has exhibited innovation during the pandemic period resulting in a rise in the uptake of its digital banking offerings .