A court has blocked Equity Bank’s #ticker:EQTY plan to put the multimillion-shilling matrimonial home of former Naivasha MP John Mututho on sale in a bid to recover a Sh20 million accrued debt.

Senior resident magistrate Peter Muholi put the planned auction of the MP’s prime property in Nairobi comprising an eight-bedroom double-storey residential house on hold until an application is heard and determined.

Equity Bank had earlier obtained orders to sell the property in Riruta Satellite, Kawangware, which it holds as securities for a Sh9 million loan the MP borrowed 20 years ago, in a public auction.

The bank, through Garam Investments Auctioneers, advertised the property for sale, prompting the MP to move to court seeking to stop the auction.

In a notice published in local dailies on April 19, Garam Investments invited potential buyers of the plush home to attend a fire sale that was to be held on Tuesday.

The Business Daily could not reach Mr Mututho for comment on the issue by press time.

Mr Mututho is disputing the loan arrears by the bank in court documents.

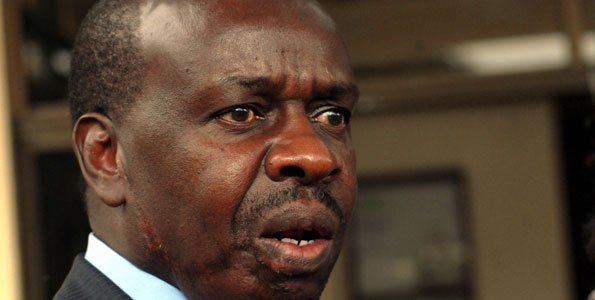

The former chairman of the National Authority for Campaign Against Alcohol and Drug Abuse (Nacada) is the latest prominent personality to battle auctioneers over unpaid bank loans.

They are struggling to hold onto their prime assets over mounting bank loans as the economy slows down and repossessions pick up.

Mr Muthutho made a name for orchestrating the Alcohol Drinks Control Act known as ‘Mututho Laws,’ that limited sales of alcohol, bar and nightclub hours.

Loans secured through title deeds and motor vehicle logbooks posted the fastest default growth rates over the nine months to last December as the country reeled from an economic crisis due to the pandemic, fresh Central Bank of Kenya data shows.