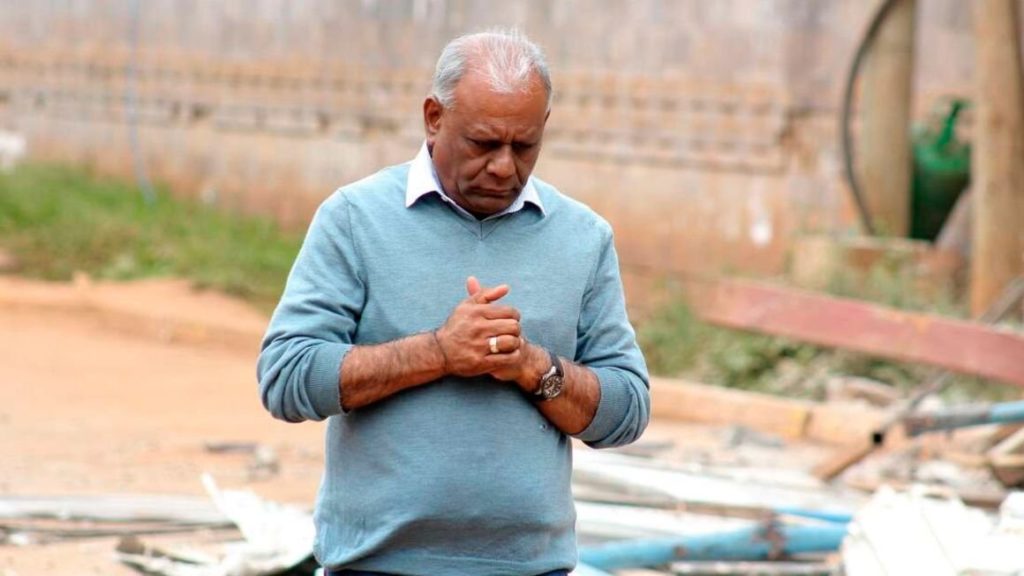

Former Nakumatt CEO Atul Shah. FILE PHOTO | NMG The former chief executive of the fallen retail giant Nakumatt, Atul Shah, will lose his Lavington home to auctioneers this month after defaulting on a Sh2 billion KCB loan he had guaranteed the supermarket.

The bank, through Phillips International Auctioneers, will sell the four-bedroom villa with a servants quarter when the auctioneer’s hammer falls on August 24.

“We will sell it through public auction on August 24. We are looking at Sh30 million,” a representative from Phillips International Auctioneers told the Business Daily yesterday.

Mr Shah, as Nakumatt’s guarantor, had used the property as additional security to offer comfort to the multiple bank loans.

KCB had earlier sold Mr Shah’s prime property in Industrial Area, Nairobi, to Furniture Palace International Ltd for Sh1.04 billion, court records show.

The Lavington home was offered as security in 2011 and accounted for Sh25 million in the multi-billion shilling loans.

The sale of the personal property marks a new low for Mr Shah, who for decades occupied the corner office of the regional retail business.

This prompted global institutions like Financial Times to name the former Nakumatt CEO as one of the top 50 influential businessmen in the world, alongside Equity Bank’s James Mwangi and Nigeria’s leading industrialist Aliko Dangote.

After the Nakumatt empire collapsed, the 59-year-old entrepreneur has preferred to keep away from the media glare.

Nakumatt, which grew from a mattress shop in a rural town to have branches across Kenya and East Africa, was forced to shut down last year as it struggled to repay its suppliers, landlords and other creditors.

Banks owed billions of shillings by the collapsed retailer are fighting over Mr Shah’s personal property to recover the unpaid loans.While the banks advanced Nakumatt billions of shillings on the strength of the retail chain’s cash flow, Mr Shah also offered his personal properties as guarantees for swift disbursements of the credit.Nakumatt closed shop in January last year with debts estimated at Sh30 billion — including Sh18 billion to suppliers, Sh4 billion to commercial paper holders and the rest to banks, who are more aggressive in pursuing their unpaid loans.Regulatory filings indicate that Nakumatt owed DTB Bank Sh3.6 billion, Standard Chartered Sh900 million, KCB Sh1.9 billion, Bank of Africa Sh328 million, UBA Sh126 million and GT Bank Sh104 million.Mr Shah says in court papers that some lenders offered Nakumatt loans with an eye on his properties and that the banks […]