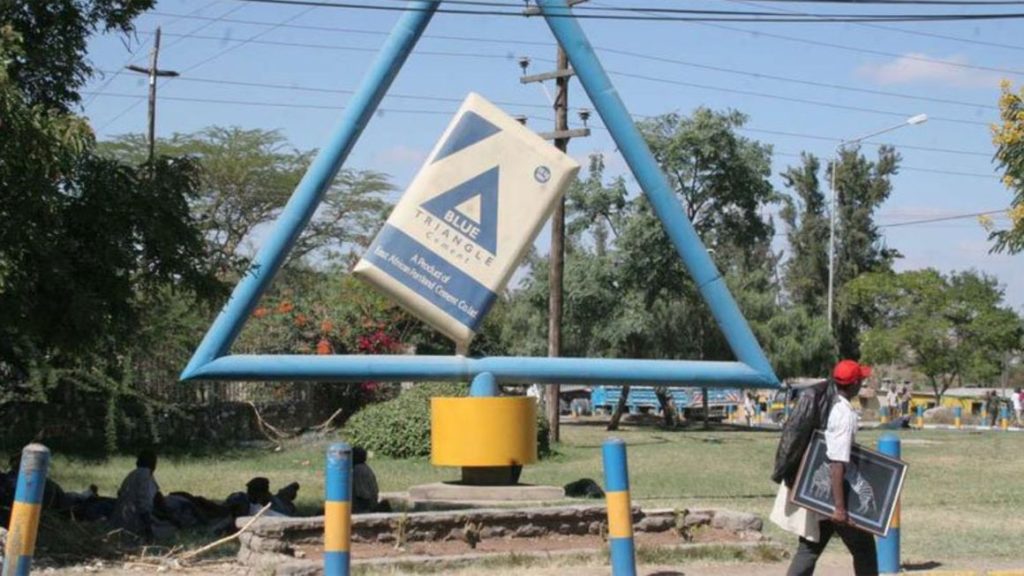

East African Portland Cement’s factory in Athi River. FILE PHOTO | NMG Financial troubles at the East African Portland Cement Company (EAPCC) have deepened after a court yesterday allowed former contract workers to attach seven bank accounts of the company to recover Sh1.3 billion salaries owed to them.

Justice James Rika allowed attachment of the bank accounts for payment of a sum of Sh1,311,585,364 to the former workers’ lawyer Nyabena Nyakundi & Company Advocates.

The attached accounts are held at Cooperative Bank, Standard Chartered, Equity Bank, two at Kenya Commercial Bank and an M-Pesa Till number account.

The judge, sitting at the Labour Court in Nairobi, also barred the company, which manufactures Blue Triangle cement brand, from issuing cheques to any company or individual from the attached accounts until the Sh1.23 billion paid.

The orders stemmed from an application filed by the former workers under the Kenya Chemical & Allied Workers union following the firm’s failure to fully implement a collective bargaining agreement (CBA).

In the application, they said the cement maker is in the process of winding up and if the banks are not forced to pay the former workers the sum of money, they stand to suffer an irreparable loss.

They said that there is a court judgment dated July 6, 2015 for payment of their salary arrears and house allowances. They said the amount was computed and adopted by the court on December 31, 2017 excluding overtime, shift allowances and leave.

"The said amount has been due and owing by the EAPCC since July 6, 2015 when the court delivered its judgment. EAPCC despite having large chunks of money in variius accounts with different banks has continually refused to pay," they told court.

Loss-making EAPCC has stepped up the search for a buyer to snap up part of its vast parcel of land for at least Sh10 billion to help it clear mounting debts owed to KCB Bank and suppliers, and unlock fresh funding to keep it afloat.

The cash-strapped firm said it is yet to find a “suitable” buyer for 2,076 acres, which shareholders voted to sell at an extraordinary general meeting in September 2019 to rescue it from insolvency after years of mismanagement amid a slowdown in property markets.

The firm has struggled to grow sales in the face of growing competition and an ageing plant, making it difficult for it to meet its obligations, including loan repayments.Justice Rika directed the union to furnish […]