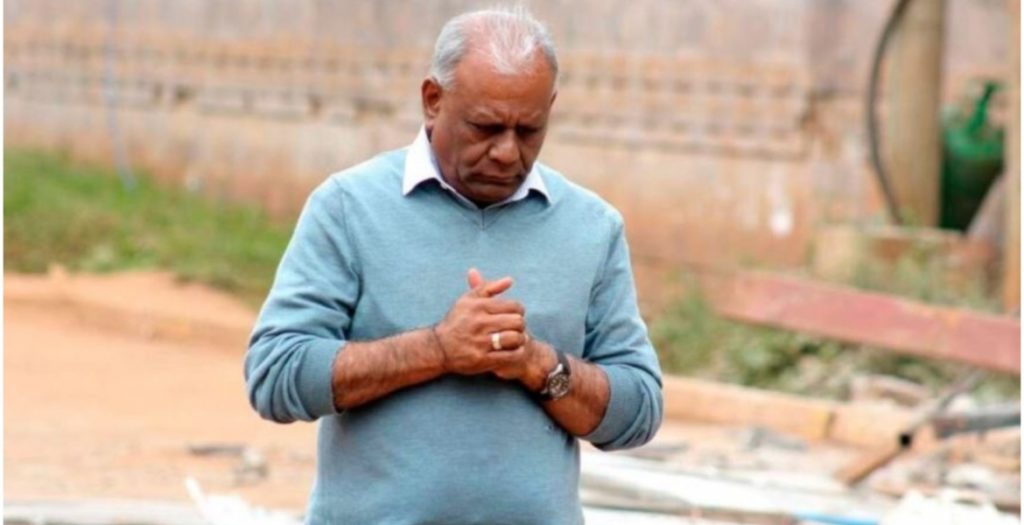

Former Nakumatt CEO Atul Shah is set to lose his home in Nairobi’s high-end estate of Lavington over a Sh2 billion defaulted loan.

The multi-million-shilling mansion was used as security for a loan given to the collapsed retail chain by Kenya Commercial Bank (KCB) in 2011.

Following the collapse of Nakumatt, the debt has remained unpaid, forcing KCB Bank to go after the businessman’s four-bedroom villa with a servant quarter.

Through Phillips International Auctioneers, the lender will sell the property valued at over Sh30 million on August 24th in a bid to recover the money advanced to Nakumatt.

“We will sell it through a public auction on August 24th. We are looking at Sh30 million,” a representative from Phillips International Auctioneers told Business Daily.

Court documents indicate that KCB had earlier sold Shah’s prime property in Nairobi’s Industrial Area to Furniture Palace International Ltd for Sh1.04 billion.

By the time it closed shop in January 2020, Nakumatt had racked up debts totaling Sh30 billion, including Sh18 billion to suppliers, Sh4 billion to commercial paper holders, and the rest to banks.

The retailer owed DTB Bank Sh3.6 billion, Standard Chartered Sh900 million, KCB Sh1.9 billion, Bank of Africa Sh328 million, UBA Sh126 million, and GT Bank Sh104 million.