The Kenya Airports Authority (KAA) has requested a cash bailout from Treasury amid piling debt, its management has said.

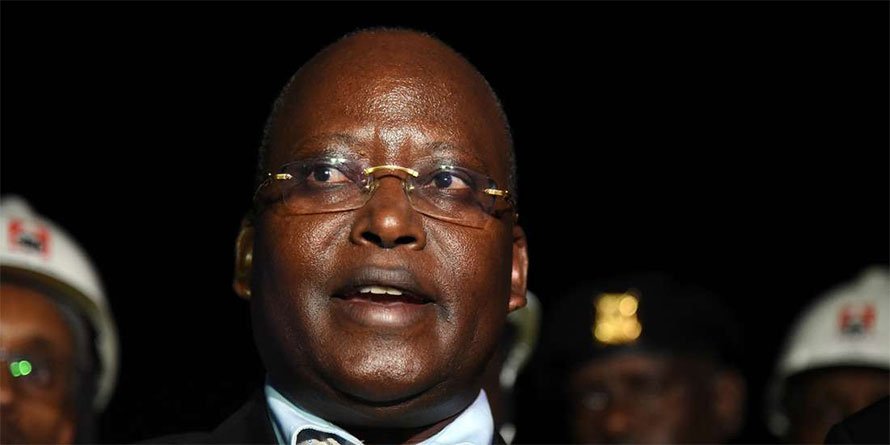

The agency’s managing director, Alex Gitari said a decision by the Treasury to mop up Sh12.5 billion surplus cash from its coffers in 2019 left it broke and unable to settle supplier debt.

“We are facing a serious cash crisis owing to the decision by the Treasury to recall Sh12.5 billion from our reserves in December 2019,” he told the Public Investment Committee (PIC) of the National Assembly Wednesday.

“The situation has been made worse by the grounding of airlines due to Covid-19 pandemic and the failure by our debtors to clear their debts,” he added.

The official said KAA has reached out to the Treasury for a bailout to help meet pressing needs, including clearance of pending bills that continue to attract interest as high as Sh12 million monthly.

“KAA position of getting bailed out has been made very clear to the Treasury hence our strategy of operating conservatively to get out of our financial position. But no hope of financial support from the Ministry of Transport and the Treasury has been forthcoming,” Mr Gitari said without providing details on the amount of cash the agency is seeking from the Treasury.

Mr Gitari said KAA had been forced to put on hold payments to contractors and suppliers due to financial constraints.

“We are struggling to pay salaries and utilities as we move forward,” Mr Gitari said.

Kenya Airways owes KAA Sh7.5 billion.

The Treasury netted Sh78.54 billion in non-tax collections including surplus cash held by State corporations in the first half of the last fiscal year, partly easing the government’s cash flow challenges.

The Treasury in a November 11, 2019 directive by Cabinet Secretary Ukur Yatani ordered State agencies to surrender surplus cash as the government raced to clear a backlog of pending bills.Mr Gitari said the current cash crunch has been made worse by the March 2020 Covid-19 induced economic fallout.