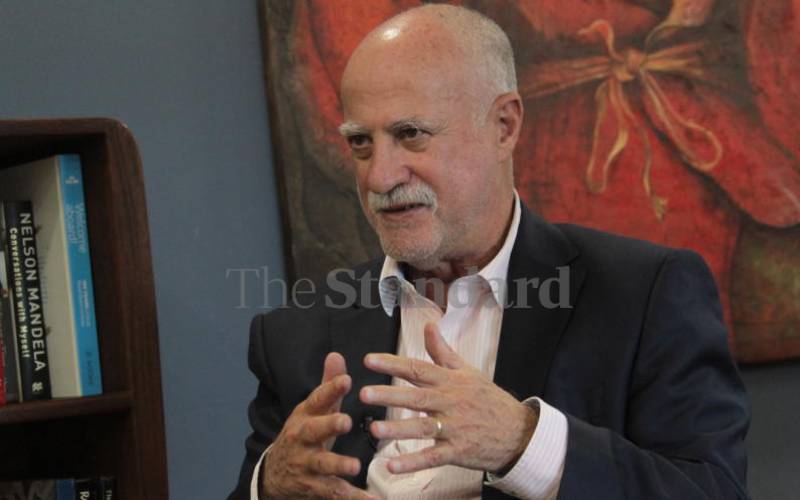

Michael Joseph joined KQ board in 2016 at a time the carrier had posted Sh26.57 billion net loss. Michael Joseph leads the boards of two different companies — one that is ranked the most profitable firm in Kenya and the region, and the other that holds the history of reporting the largest loss in corporate Kenya.

He is the chairman of Safaricom and leads the board in making key decisions to take the telco’s profitability to the next level.

But he is also the chairman of Kenya Airways (KQ), the national carrier whose ‘Pride of Africa’ tagline has not saved it from a nine-year loss streak.

In the last nine years, Safaricom’s accumulated profits add up to Sh419.13 billion — more than enough to fund all the 47 counties in a year — while KQ’s losses have accumulated to Sh146.27 billion.

Mr Joseph’s wife thinks her husband will exit KQ with a damaged brand. But he is not about to give up.

“It is a tough business. My wife tells me all the time: “Just give up,” said Mr Joseph in an interview with The Sunday Standard.

“The risk in the responsibility of me being the chairman of KQ is that Kenyans expect that I, Michael Joseph, can save and reproduce the financial successes at Safaricom.”

Mr Joseph was the founding CEO of Safaricom, growing the customer base from less than 18,000 in 2000 to over 17 million subscribers at his retirement in November 2010.

This growth, straddling nearly a decade, was motored by the launch of many innovative products and services. None has stood out more than M-Pesa.

Mr Joseph says unlike the experience at Safaricom, with KQ, he knew he was going where “everybody maligns you and shouts at you.”

He thinks KQ can return to profitability by 2025 and win back the hearts of Kenyans who now view the airline as a mysterious bottomless pit that is always feeding on taxpayers’ money, yet keeps growing weaker.“All these people talking about wasting taxpayers’ money on KQ either don’t understand that this is a strategic asset of the country or understand but say so because it is politically a good thing to say,” he says.Mr Joseph in 2016 agreed to join the KQ boardroom at a time the airline had posted a Sh26.57 billion net loss — then the highest in corporate Kenya for a listed firm.The same airline broke its own record with a Sh36.22 billion net […]