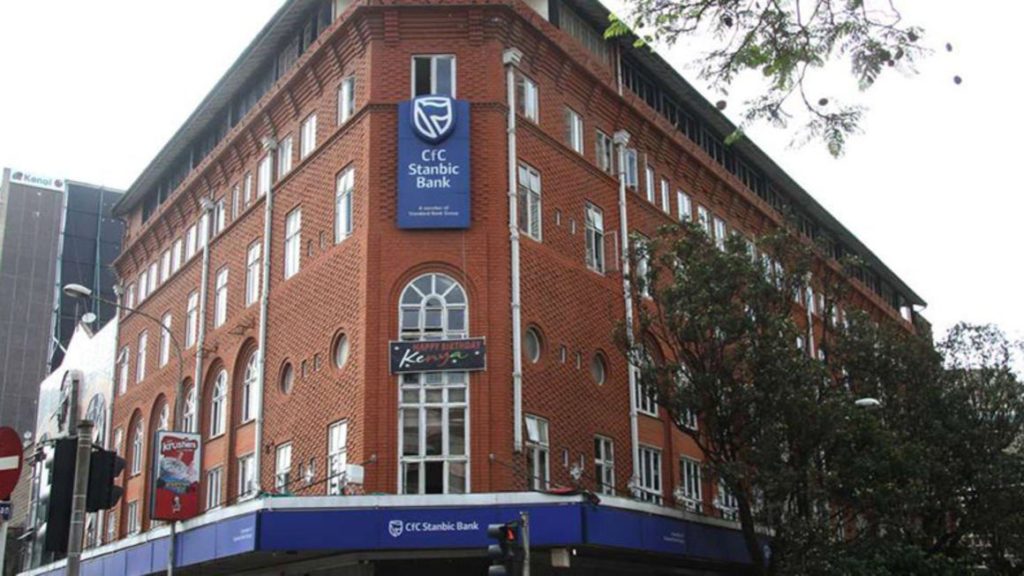

A Stanbic Bank branch on Kimathi Street, Nairobi. FILE PHOTO | NMG South Africa’s Standard Bank has been given one year to complete the purchase of more shares in its local subsidiary Stanbic Holdings with a target of attaining a 75 percent stake.

This marks the latest extension of the buying window since the multinational started acquiring Stanbic’s shares in May 2018 by offering a buyout price of Sh95 per share.

Standard Bank, which had raised its ownership in the subsidiary to 72.25 percent as of December 2021, now has up to the end of this year to buy the remaining 10.5 million shares based on prevailing prices on the Nairobi Securities Exchange (NSE) .

The target shares have a current market value of Sh1 billion based on Stanbic’s current share price of Sh94.5. The South African bank is making share purchases through its investment vehicle Stanbic Africa Holdings Limited (SAHL).

“SAHL is pleased to announce that the Capital Markets Authority has granted a further extension of the exemption to trade on market for a period expiring on December 31, 2022,” the company said in a notice.

“SAHL will aim to acquire a maximum of 10,588,143 additional ordinary shares … available for sale on the NSE in accordance with the applicable rules. If successful, SAHL’s shareholding will increase to its target shareholding of just under 75 percent of the issued ordinary shares in Stanbic Holdings.”

Standard Bank’s plan to boost its stake in the Kenyan subsidiary has been slowed down by minimal supply of shares in the market, with most of the stock held by institutional investors who hardly trade.

Investors traded 500 Stanbic shares yesterday, with the stock price unchanged at Sh94.5.

The move to buy shares at the market comes after an initial offer to buy out minority shareholders at a price of Sh95 per share failed to secure all the additional stock the multinational was targeting.

The offer ran from May to July 2018 and saw acceptances of 31.6 million shares — for which Standard Bank paid a total of Sh3 billion— against the target of 59 million shares.

This raised its stake to 68.01 percent from the previous 60 percent and the multinational has been increasing it in subsequent open market stock purchases.Standard Bank’s move to raise its ownership in Stanbic signals its confidence about the subsidiary’s future prospects. The bank is one of its most important units outside South Africa. vjuma@ke.nationmedia.com