The Insurance Regulatory Authority of Uganda (IRA) has published industry performance for the period April-June 2021 (Q2) with Bancassurance recording a 54% growth dominated by Stanbic Bank Uganda which consolidated its market share to 21.2% from 19.1 between January and March.

According to IRA, the insurance industry registered impressive growth in the first six months of 2021 on account of improved product uptake and interest generating a total of UGX600bn in gross premiums.

Bancassurance (life assurance and other insurance products sold through banking institutions) contributed 8.2% of the industry’s total business in the first six months of the year.

In 2020, the bancassurance sector produced UGX32bn (full-year volume) compared to UGX49.3bn in the first half of 2021 which represents a 54.24% growth, as per an industry report published by the regulator.

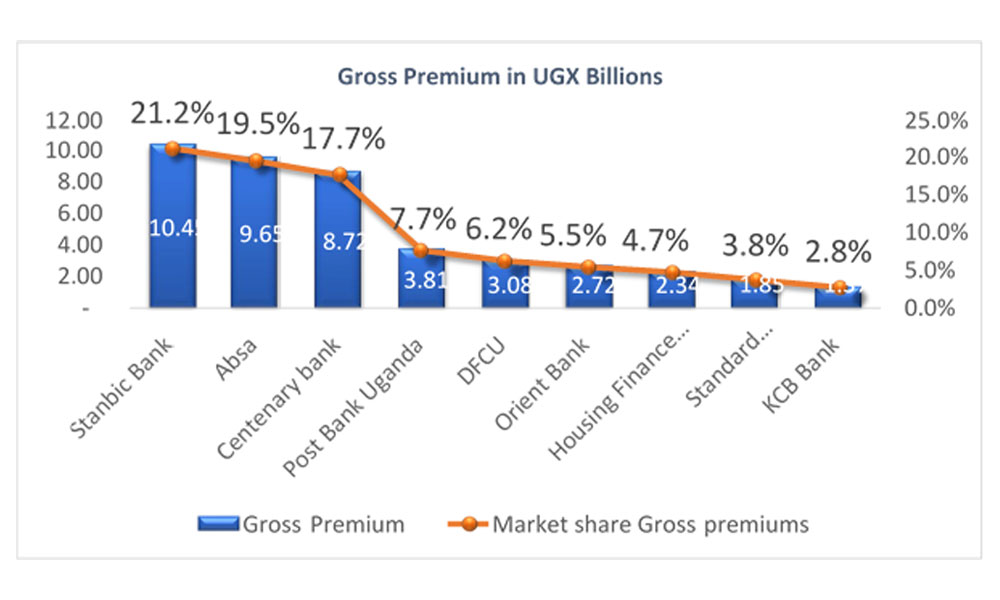

For the period under review (April-June 2021), Stanbic Bank consolidated its first position by growing its industry market share from 19.1% in Q1 2021 to 21.2% in Q2 of 2021.

Stanbic Bank’s bancassurance business dominated its rivals in the industry, attracting UGX10.4billion in total Gross Premiums for the period April-June 2021.

The bank also outearned its peers, raking in UGX1.91bn representing 24.4% of all bancassurance commissions paid to banks for the period under review.

Stanbic Bank also dominated bancassurance business for Non-life (General insurance) product- lines generating UGX3.5Bn which is equivalent to 28% of total industry volumes.

Moving forward, Singh Dogo, Stanbic Bank Uganda’s Head of Bancassurance said focus will be on gaining market leadership for the Life insurance business where the lender enjoys 12% market share equivalent to UGX6.9Bn but two percentage points behind the top spot holder.

He added that the bank’s good performance in the second quarter was driven by growth in general insurance and credit life business as well as short-term insurance covers for clients.

“These are stable, and our projection is that they will continue to grow on account of their unique positioning to address customer coverage needs coupled with our assured fast claims service,” Dogo explained.For the period ahead, Dogo sees Stanbic’s Bancassurance efforts focusing on expanding dominance in individual life products with value propositions on essential services such as Education, Medical, and life insurance policies.“As Stanbic Bank transforms into a platform business, we hope to leverage on digital, data and behavioral science investment to drive growth, backed by enhanced ability to anticipate and respond to client needs and developing the right solutions for them,” he said.