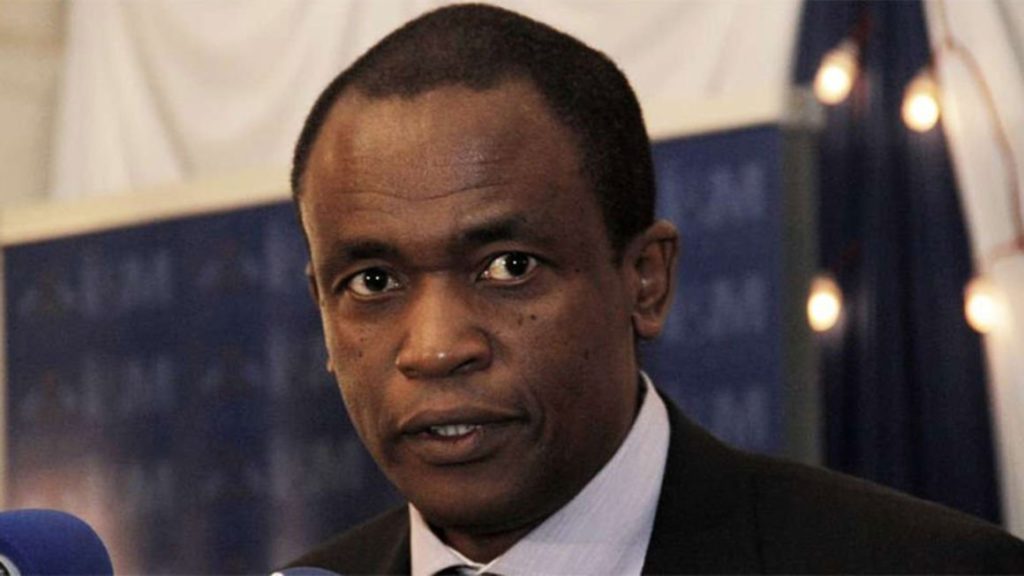

Public Debt Management Office director-general Haron Sirima. FILE PHOTO | NMG Kenya has raised Sh108 billion ($1 billion) in a Eurobond issuance, at an interest rate of 6.3 percent for the 12-year bond that is the fourth sovereign debt to be floated by the country since 2014.

The Treasury said that the offer was oversubscribed more than four times, attracting bids worth Sh582.7 billion ($5.4 billion).

The country had been shopping for investors for the bond since Tuesday in a virtual roadshow, and said on Thursday evening that it hit its target of Sh108 billion in less than a week for the loan whose principal will be paid back in two tranches to ease repayment pressure down the road.

The public debt management office has been working to reduce borrowing rates and lengthen or stagger repayment periods to ease pressure on the country’s cash flow.

“We went to the market seeking to raise $1 billion and stuck to the discipline of our target amount despite the oversubscription and competitive pricing,” said Dr Haron Sirima, the director general of the Public Debt Management Office.

“Going forward we are optimistic that Kenya will successfully execute liability management operations in the next fiscal year in line with the debt strategy of lowering cost and minimising risks in the public debt portfolio.”

Amortising the bond— meaning that principal is paid down in instalments rather than in one bullet payment at maturity— will ease the rolling over of the bond when it becomes due.

This will help the country to avoid the headache of looking for a huge amount of dollars at one go to pay back the lenders, like will be the case in June 2024 when the $2 billion, 10-year tranche first Eurobond issued in June 2014 falls due.

“Final maturity (is on) 23 June 2034. Principal repayment is in two equal instalments on 23 June 2033 and 2034,” said the Treasury in roadshow documents seen earlier by Business Daily.

Experts say that the country’s risk profile has been lowered by the backing of the IMF and the World Bank, which have agreed programmes in excess of $4 billion in the past one year.

This has reassured investors that that the country is unlikely to face balance of payment problems, at least in the short term when the Covid-19 problems have hit economies hard.This meant that investors in the new Eurobond were unlikely to demand a bigger premium in interest when […]