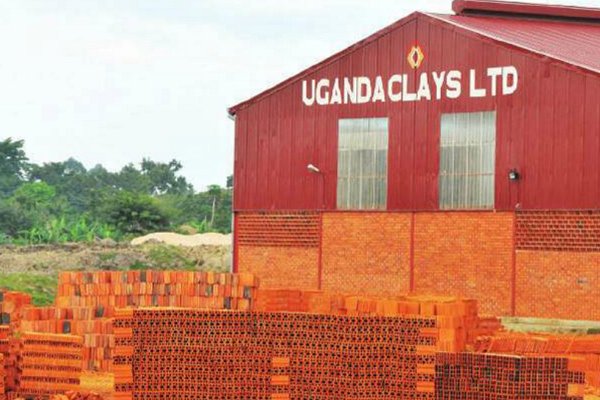

Uganda Clays overcame a difficult year to register an increase in net profit during the period ended December 2020.

The company, which has recorded a streak of mixed performance in the last five years, however, saw net revenue decline due to Covid-19 related disruptions and intense competition from direct and alternative products.

During the period, the company noted an increase in net profits by 5,639 per cent from a loss of Shs88.4m in 2019 to Shs4.9b in 2020.

Profit before tax increased by 43 per cent to Shs13.5b from Shs9.5b in 2019, driven by cost management initiatives and a decrease in the cost of sales and production.

Uganda Clays, which is listed on the Uganda Securities Exchange, has seen its stock experience long periods of inactivity with its share going for between Shs8 and Shs10 for more than five years.

However, despite the tough times, the company continued to show resilience but was not immune to the impact of Covid-19 disruptions.

During the period, Uganda Clays saw overhead costs decrease by 15 per cent to Shs9.4b from Shs11.1b due to cost-cutting initiatives.

Revenue performance dropped by 3 per cent to Shs29.7b in 2020 from Shs30.7b in 2019 due to business disruptions impacted by Covid-19.

Total assets increased by 11 per cent to Shs68.8b from Shs62.2b in 2019 while cash generated from operating activities stood at Shs6.1b compared to Shs6.3b over the same period in 2019.

The decline was due to a drop in sales as a result of the impact of Covid-19 on the business.

Uganda Clays in March appointed Mr Reuben Tumwebaze, a former director at Uganda National Roads Authority as the new managing director, to replace Mr George Inholo, who was sacked in March 2020 over failure to deliver and turn around the company.

Mr Tumwebaze will have to work hard to close out losses occasioned by the Kamonkoli factory in eastern Uganda.

Kamonkoli factor

Uganda clays continues to battle inherited losses attributed to higher operating costs occasioned by the Kamonkoli factroy that had been put up in an ambitious expansion strategy.

The expansion to Uganda’s east in Kamonkoli in 2009 has had a troublesome streak that continues to eat into the company’s revenues.