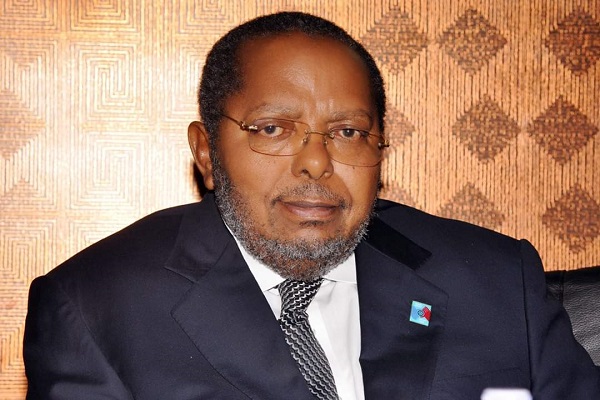

BoU Governor Tumusiime Mutebile Uganda can still meet its debt obligations despite continued borrowing, the Bank of Uganda (BoU) said in its latest report on the ‘State of the Economy’, which presented the global and domestic economic developments in the period to August 2020.

“Despite the increase in borrowing, Uganda’s debt levels remain sustainable with low risk of debt distress; however, significant vulnerabilities are evident,” reads the report in part.

The optimistic outlook from the central bank comes after activists and President Museveni himself has called on lenders to forgive debts to Low-Income Countries (LICs), especially after the damage caused by the Covid-19.

In September, the Uganda Debt Network (UDN) argued that canceling these debts would help countries like Uganda channel the funds spent on servicing debts to development projects.

UDN recommended that all debts lent to LICs be canceled and that these countries be given a 10-year action of no-interest on new debts.

“The two-fold approaches would consign the LICs into more public expenditure investments tagged to protecting the rights and social protection of the citizens, economic recovery, improved healthcare and others,” it said.

“Uganda Debt Network implores the IMF, WBG and G.20 (world’s richest countries) during 2020 to coordinate such a compelling broad global participation of all global actors to this two-fold approach to the revival of economies of the LICs, including Uganda.”

According to BoU, the total public debt stock stood at Shs56.53 trillion, 40.8 percent of GDP, as at the end of June 2020 which is an increase of 20.5 percent relative to June 2019.

“The increase between June 2019 and June 2020 was mainly due to a Shs6.4trn increase in external debt largely attributed to borrowings from the IMF, Trade and Development Bank (TDB), and Stanbic Bank towards countering the economic distress brought about by the COVID-19 pandemic,” BoU report says.

“Public external debt continued to maintain the dominant share of 66.2 percent of the total public debt. External and domestic debt increased by 18.0 percent and 19.4 percent, respectively in FY2019/20. The external position in FY 2019/20 was supported by budget support loans from the Trade and Development Bank, IMF and Stanbic Bank.”

Between January and August, Uganda acquired about 16 loans acquired to counter the effects of the pandemic and for other interventions in the economy. Those loans exclude the grants and supplementary budgets at end of FY2019/20.However, the more debts the country plunges in the harder it becomes for it to […]