Analyst bemoans crowding out effect on private sector The country’s banking sector holds half of the country’s domestic debt – meaning the financial sector has become more comfortable investing in government instruments than lending to the private sector, a situation that a financial analyst says is a threat to the recovery plan.

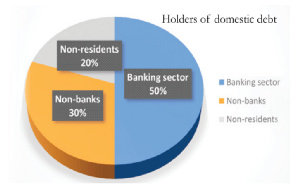

According to the Bank of Ghana ’s statistical bulletin (May) report, out of the total domestic debt of GH¢171.7billion as of May 2021, the banking sector – which includes the Bank of Ghana and commercial banks – holds GH¢86.5billion representing 50 percent of the debt, and is an increase in GH¢20billion from May 2020.

When further broken down, of the GH¢86.5billion the Bank of Ghana holds GH¢34.6billion while the commercial banks hold GH¢51.8billion – indicating that commercial banks are very active in the bond and Treasury bills market.

In fact, their holding in the domestic debt is bigger than the GH¢51.5billion held by the non-bank institutions which include SSNIT, insurance companies, rural banks, pension firms, and other institutions, and individuals. The rest of the debt, GH¢33.6billion representing 20 percent, is held by non-residents.

The structure of domestic debt further reveals a whopping GH¢104.8billion is made up of investments in the government’s medium-term bills such as two-year Treasury notes and 10-year bonds. Then, GH¢22.6billion is also made of short-term bills such as the 91-day Treasury bill to one-year Treasury notes. The remaining GH¢44.2 billion also went into long-term bonds such as 15-year bonds and above.

Commenting on this in an interview with the B&FT, professor of finance and dean of University of Cape Coast Business School, John Gatsi, expressed concern about the impact of such a development on the private sector, saying businesses are being starved of financial support at the time they need it most.

“It means the domestic debt market is largely serving the interest of the government and not really the private sector interest. The crowding-out effect is in the domestic debt market structure in which the commercial banks, including the Bank of Ghana and non-banking financial institutions – including insurance companies and pension funds – are more oriented toward giving their money to the government through the purchase of the bonds that the government issues.

“And that is clearly not a good development for the private sector’s access to credit – especially at a time when credit is more important for the private sector to restructure their businesses and stay focused,” […]