On 21st December 2020, Homeboyz Entertainment Plc listed on the Nairobi Stock Exchanges GEMS with one of the grooviest and visually stimulating IPO launches, streamed on Youtube with an in-house DJ.

Homeboyz Entertainment Plc is the company behind Tinga-Tinga, HB TV, Homeboyz radio station and many other media brands. The company has a rags to riches story, having started out as a small DJ outfit under 30 years ago.

It is the first entertainment focussed company to join the Nairobi Stock Exchange.

With a heart-warming back story, exciting brands and a glitzy listing launch yesterday, is it the kind of company you should have in your portfolio?

To help you make up your mind, we are going to list 7 questions you should ask yourself before you buy, and provide some information to answer them;

1. Do I understand Homeboyz Entertainment's business?

Homeboyz Entertainment is famous for its radio and TV brands, media productions like Tinga-Tinga, and the many events it puts on.

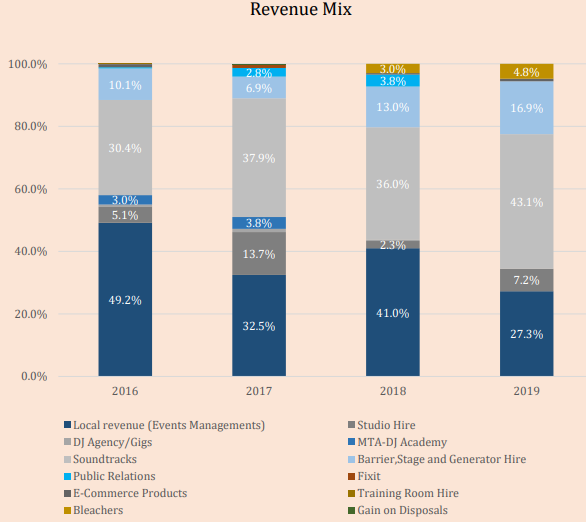

Its biggest revenue driver is Soundtracks - creating music/jingles for corporates or campaigns. This business segment generates over 40% of revenue and is the most profitable with margins over 50%.

The focus of the business is to move more into e-Sports due to its experience in gaming and the fast-growing market for it especially in South Africa.

So what may look like you are buying a TV, radio and events company, is actually more a soundtracks company with an eye on e-sports.

Soundtracks are the biggest revenue driver for Homeboyz Entertainment

2. Do I know who is running Homeboyz Entertainment?

Once you invest your money in Homeboyz Entertainment, the Board of Directors and senior management will be the people in charge of ensuring that your investment is fruitful.

The Board of Directors and Senior Management make the decisions that shape the future of the company and therefore your investment.

The co-founders are currently sitting on the Board of Directors.

3. Do I know who my fellow shareholders are?

When you buy shares, you will become a one of the company's shareholders. As a shareholder you have a right to make decisions about the company including who sits on the Board of Directors.

The actions of shareholders are the reason why share prices go up and down, irrespective of how the business performs therefore knowing them is key

The largest shareholders are;

4. Does Homeboyz Entertainment make money?

Investing is usually done to make money, and only companies that themselves make money can make you money.

Sales/Revenues: In 2019, Homeboyz Entertainment did make money about $3m in revenues but this a lot less than in 2016 when it almost made $4m.

Profits: The company has had more loss-making years than profitable ones though 2019 was its most profitable year

Profit Margins: Profit margins have been low but it 2019 they hit 11.7% which is higher than comparable listed companies like Nation Media Group

Revenues remain about $3m but have been falling since 2016

Profits have risen sharply in 2019 but that is after 2 years of losses

Good profit margins once they start to make some profits, better than some competitors

5. Will Homeboyz Entertainment make me money?

The assumption is that you would make an investment in Homeboyz Entertainment for profit.

The best measures we use to see if a company has a track record of making money is looking at the movement in share price (for capital gains) and dividends (for income).

Due to this being a newly listed company that would not help so we will focus on Return on Equity (ROE), which you can use to compare to other investments.

Homeboyz Entertainment had an ROE of 92% in 2019, this is superb but it is less impressive when you consider this is more to do with the little equity in the business than levels of profitability.

Returns on investment can be high but this has only started in 2019

6. Is Homeboyz Entertainment financially stable?

The two things that can bring any company to its knees however good its business or products - is too much debt or lack of cash.

Debt: Debt levels for Homeboyz Entertainment have fallen significantly from 2018 where they were 33 times the equity in the business. They still remain 2 times greater than equity.

Cashflow: Homeboyz Entertainment has continuously been able to generate cash through its operations except in 2018. The level of cash generated has gradually fallen over the last few years.

Debt levels have fallen from 33x of equity in 2019 to 3x

Company continues to generate cash ($120k) but a third of profits ($359k), are all invoices being paid?

7. Is the management team increasing business value?

The responsibility of the management team is to "sweat" the assets of the business - make as much profit using the assets available, and sustainably increase the value of my stake in the company.

Sweating assets: In 2019 when Homeboyz Entertainment was profitable, it was generating 1/- of profits for every 4/- of assets, which is a lot better than its competitors.

Earnings per Share: Profitability has been erratic so no consistent growth in earnings/profits per share. The listing price was 8 times the earnings per share in 2019.

Book Value: The value of the business based on its financial records rose (10X) significantly in 2019 to $391k but this is still only 1/8 of this market cap.

Homeboyz is sweating its assets better than competitors but for how long can they keep it up?

Earnings per share shot up in 2019 to its highest in 5 years after two years of losses.

Based on company's financial records the business is worth 0.33/- per share

Conclusion

Once you can answer these questions about Homeboyz Entertainment, then you will have the infromation that can help decide whether buying this share will could be appropriate for you portfolio.