NAIROBI, Kenya, Aug 28- Jubilee Holdings Limited has announced a profit of Sh1.8 billion for the half-year ended June 30th, 2020.

The performance has been attributed to improved insurance underwriting results from all of its Group operations across the region and robust investment income from its well-diversified and secure investment portfolios that are designed to deliver consistent long-term returns.

The Group recorded a Profit after tax of Sh1.8 billion, an increase of 4.8 percent from 2019, while total assets increased by 8 percent to Sh 140.1Bn from Sh 130.1billion.

During the same period, Total Comprehensive Income increased by 5.1 percent to Sh1.8billion from Sh 1.7 billion for the same period in 2019, and Profit After Tax remains unchanged at Sh 1.8 billion.

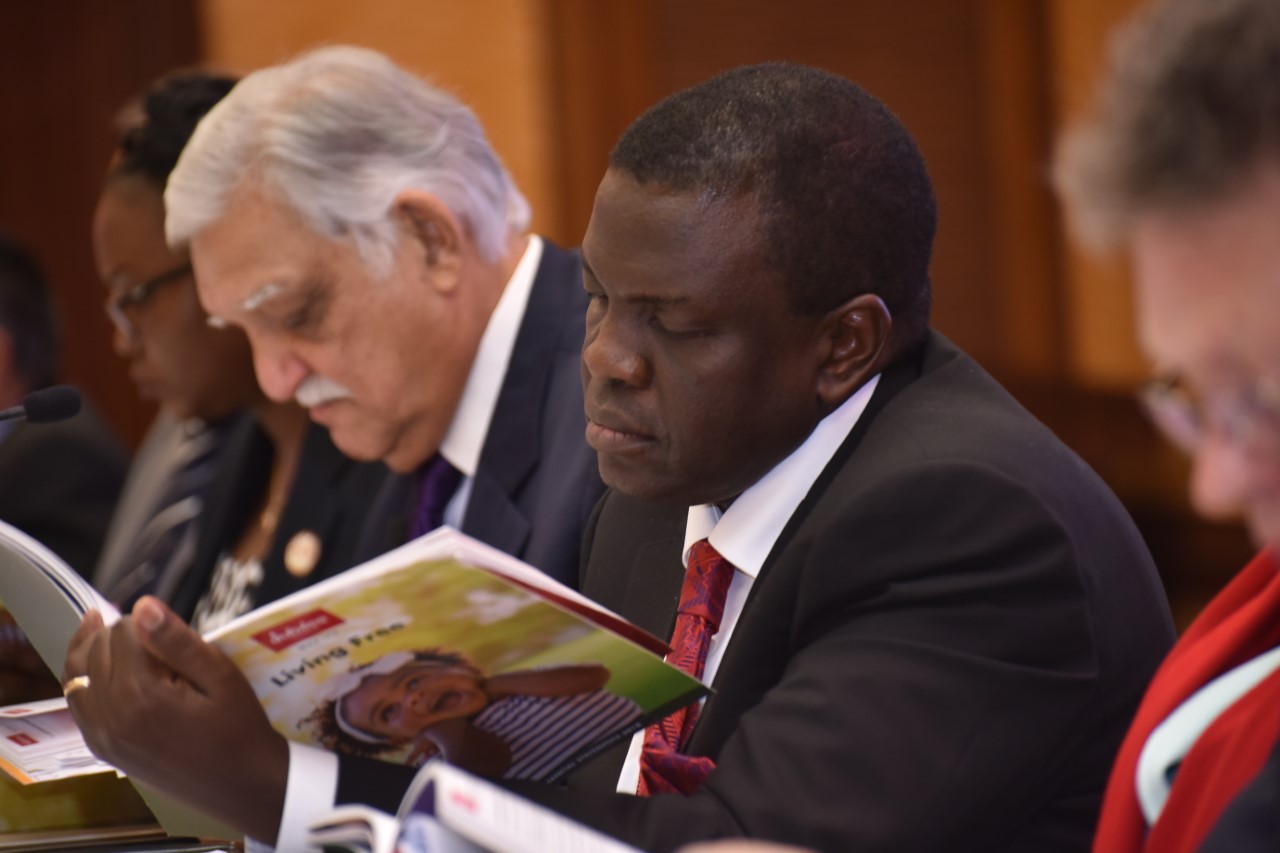

Commenting on the performance, Jubilee Holdings Limited Group Chairman Nizar Juma noted that COVID-19 has severely impacted insurance operations globally. “The first half of the year was characterized by significant macroeconomic and financial impacts resulting from the COVID-19 pandemic. It is however gratifying to note that despite the unprecedented circumstances, the Group’s half-year results demonstrate a resilient operating performance and confirms the Group’s conservative and prudent approach to both the insurance and investment components of our business,”Juma said.

The pandemic had mixed and varying impacts on the different lines of business of the Group.

Whilst overall growth in premiums stalled, the Group registered lower claims volumes in the motor and health insurance, but also experienced increased surrenders and withdrawals within the life insurance operations.

The lowering of the yield curve across the region had the dual negative impact of generating lower investment return from the fixed income portfolio and necessitating an increase in the long-term insurance contract liabilities.

However, overall investment income increased by 3.8 percent to Sh4.98Bn as a result of the Group’s growing portfolio of investment assets.

The Group has also initiated efficiency measures across all companies to control expenses, which resulted in savings against budget at the half year and identified opportunities to reduce costs further as efforts are made to navigate the challenges arising from the uncertainty created by the Covid outbreak

The Life Business continued to show good performance accounting for 37 percent of the Group’s Gross Written Premiums while contributing 22percent towards the profit mix.Group Life performed better than 2019, contributed to by portfolio management and the onboarding of new clients.Individual Life performed better than last year through the bancassurance platform and increased use of digital channels, which enabled Jubilee […]