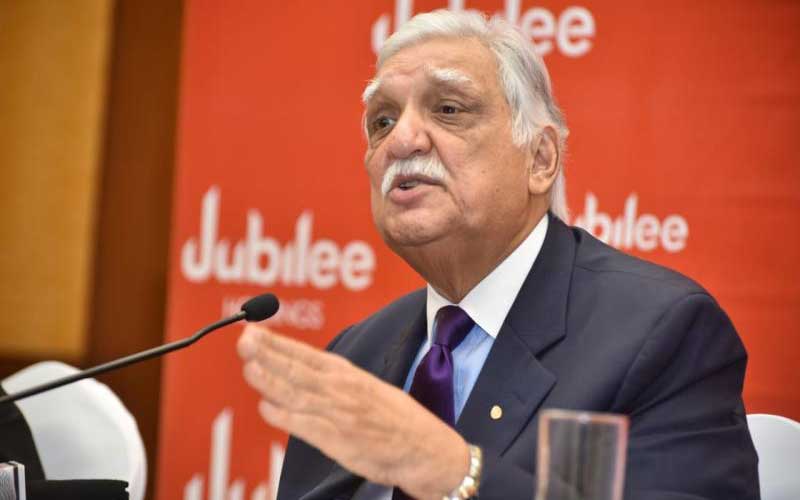

Jubilee Holdings Chairman Nizar Juma. [File, Standard] Jubilee Holdings’ net profit remained flat at Sh1.8 billion for the first six months of 2020 compared to same period last year amid devastating effects of coronavirus pandemic. The insurer saw its net premium revenue rise slightly from Sh9.56 billion to Sh10.14 billion as at the end of June 2020. Group Chairman Nizar Juma said the pandemic had severely impacted insurance operations globally. Covid 19 Time Series

“The first half of the year was characterised by significant macroeconomic and financial impacts resulting from the Covid-19 pandemic,” he said. Despite the unprecedented circumstances, he said, the company’s half-year results demonstrated a “resilient operating performance and confirms the group’s conservative and prudent approach to both the insurance and investment components of our business”. The pandemic had mixed impact on the firm’s different lines of business. While overall growth in premiums stalled, the group registered lower claims in motor and health insurance. It however experienced increased surrenders and withdrawals within the life insurance operations. The company said it had initiated efficiency measures across all companies to control expenses, which resulted in savings against budget at the half year. Jubilee Holdings Regional Chief Executive Julius Kipng’etich said they had put in place the necessary “work from home” measures to ensure all business processes continued without interruptions. “Additionally, the group accelerated the innovation and digital transformation process to provide online sales to customers through the launch of the self-service digital portal,” he said. The Life business accounted for 37 per cent of the group’s gross written premiums as the firm put in place measures to protect its policyholders and introduced a raft of waivers.