Landmark issuances of green instruments suggest a growing trend in the Middle East and North Africa; Lebanon’s beleaguered banks prepare for another challenging year; and Kenyan lenders are set to benefit from a risk-based loan pricing model.

Green financing set to grow

Green sukuk and bond issuance in the Middle East and North Africa region will likely increase in 2021 as governments and state-linked companies seek to diversify their financing sources and take advantage of falling pricing.

Investor appetite for regional green debt appears strong, with three landmark issuances in September. Egypt’s $750 million, five-year bond was the first by a MENA sovereign and received $3.7 billion of orders, while state-controlled Saudi Electricity Co.’s $1.3 billion green sukuk was 4x oversubscribed. Investors from Europe and the U.S. bought 88% of Egypt’s bond, which carries a coupon of 5.25%. Qatar National Bank (QPSC)’s $600 million of unsecured notes, which MENA’s top lender by assets will use to finance green projects, attracted orders totaling $1.8 billion.

"There is a desire amongst borrowers to align what they’re doing from a funding perspective with overall commitments to corporate social responsibility organizationally," said Stuart Ure, a partner at Clifford Chance law firm in Dubai. "Moreover, amongst borrowers, there’s a desire to continue to diversify funding sources and seek liquidity."

National Bank of Abu Dhabi — now First Abu Dhabi Bank PJSC — issued MENA’s first green bond in 2017. At that time, there were questions as to whether selling green debt required issuers to pay a premium above their established yield curve. Now, the depth of investors seeking exposure to investment-grade environmental, social and governance products has increased, while Gulf issuance of such instruments remains below other regions.

"Consequently, green bonds are pricing flat to existing credit curves, and in many instances lower," Ure said.

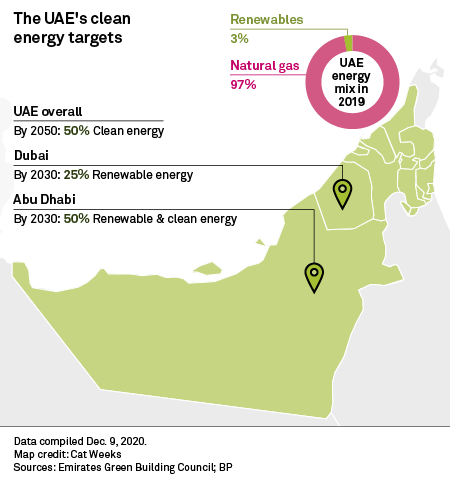

"In 2021, particularly in the Middle East, we will continue to see from clients — sovereigns, corporates and financial institutions — more and more queries on the required framework and processes for issuing green bonds/sukuk." In the United Arab Emirates, ambitious plans are in place to expand the country’s capacity to produce clean and renewable energy. The Gulf’s continued development of large-scale solar power plants and investments in other environmentally beneficial infrastructure should lead to increased activity in green financial instruments, although bank financing is usually the main means to fund large-scale regional projects.

"The Gulf is still at a relatively early stage of […]