The Fuliza overdraft service transacts more than Sh1.2 billion daily. Safaricom’s overdraft facility, Fuliza, has taken less than three years to capture the digital lending market.

But the telco’s climb to the pinnacle of the market segment has been anything but smooth.

It started with M-Kesho—the ill-fated product launched by the mobile service provider in partnership with Equity Bank in 2010.

Hailed then as the pioneer mobile banking application, M-Kesho would later fade away as the two firms fought over commission sharing and other issues.

The product enabled customers to deposit and withdraw money from their M-Kesho account by transferring value to and from their M-Pesa account. READ MORE

While the product failed, Safaricom walked away with valuable lessons on how to partner with banks—the institutions that once opposed M-Pesa.

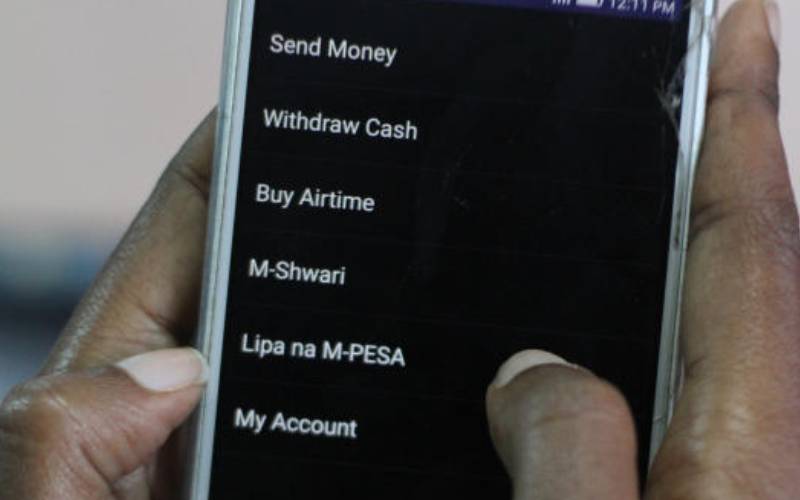

Two years later, M-Shwari was born. Safaricom struck a deal with Equity’s rival, CBA Group—now NCBA after the merger with NIC.

This was followed by another partnership between Safaricom and KCB to form KCB M-Pesa.

The two products allowed both banks to lend to customers and take deposits via the M-Pesa platform.

M-Shwari and KCB M-Pesa resonated with Kenyans seeking microloans for their daily and monthly needs such as food and rent payment.

The services enabled customers to save as little as Sh1 and get loans from Sh50 in a move that saw many people get hooked to the products.Then in 2019, Safaricom launched a new product dubbed Fuliza. It has since taken the market by storm and averaged Sh1.34 billion in daily lending in the six months ended September this year.Fuliza’s entry has upset the popularity of M-Shwari and KCB M-Pesa, with M-Pesa users seeking microloans getting hooked to the overdraft service.The product allows customers to access unsecured credit by overdrawing on M-Pesa to cover short-term cash flow shortfalls, subject to predetermined limits. Safaricom says the average ticket size on Fuliza is Sh375.80, a figure which resonates well with many people requiring money to sort out emergencies such as buying food, paying for bus fare, refilling cooking gas and buying electricity tokens.Fuliza’s value of disbursements hit Sh244.6 billion in the financial year ended March 2020, while those of M-Shwari and KCB M-Pesa stood at Sh129.6 billion and Sh116.6 billion respectively.But the tide shifted in the financial year ended March 2021, with Safaricom disclosing that Fuliza borrowing had jumped by Sh106.6 billion, or 44 per cent, to Sh451.2 billion.However, during the same period, M-Shwari loans reduced by 56 […]