The pressure to scrap the law has been mounting for a while with banks leading the assault.

Analysts believe it is only a matter of time before it is done away with.

However, while the law still holds, SMEs are facing tough times getting credit as they are considered too risky by lenders.

One of the reasons that has triggered a widespread chorus for repeal of the law capping interest rates, is that it has starved small businesses of credit.

The pressure to scrap the law has been mounting for a while with banks leading the assault.

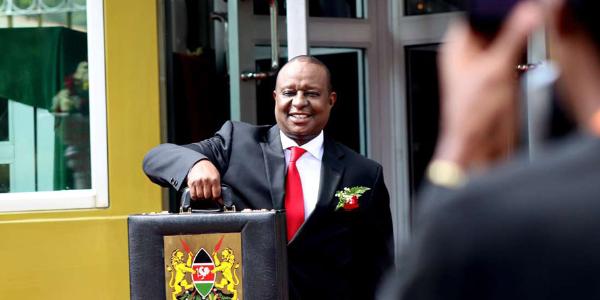

The Treasury and Central Bank have also strongly indicated a desire to get rid of the legislation saying it has turned into a millstone around the economy’s neck.

Analysts believe it is only a matter of time before it is done away with.

However, while the law still holds, SMEs are facing tough times getting credit as they are considered too risky by lenders.

Investment by banks in government securities has been growing as rapidly as the lending to small businesses has been falling.

While the law was meant to spur uptake of credit and stimulate the economy, the reverse has indeed happened.

The latest report by Cytonn Investments on banks listed on the Nairobi Securities Exchange (NSE) shows that uptake of treasuries has grown by 25 per cent in the first quarter of this year, outpacing loan growth of 3.2 per cent.“The effects of the Banking (Amendment) Act 2015 have continued to be felt in the sector, with banks recording a two per cent decline in loans and advances to Sh1.9 trillion in the first quarter of 2018 from Sh2 trillion in financial year 2017. Credit standards This could be attributed to banks tightening their credit standards owing to the Banking (Amendment) Act 2015,” analysts at Cytonn Investment said.

The law limits lending rates at four per cent above the Central Bank Rate (CBR), and a floor on the deposit rates at 70 per cent of the CBR.Besides pushing for the removal of the law, the Treasury has formulated the draft Financial Markets Conduct Bill, aimed at assessing the whole credit management in the economy.The Bill seeks to ensure better conduct by banks and other lenders in terms of extending credit to retail financial customers.The proposed law does not define banks as the sole lenders, opening the door for other credit companies to offer loans.