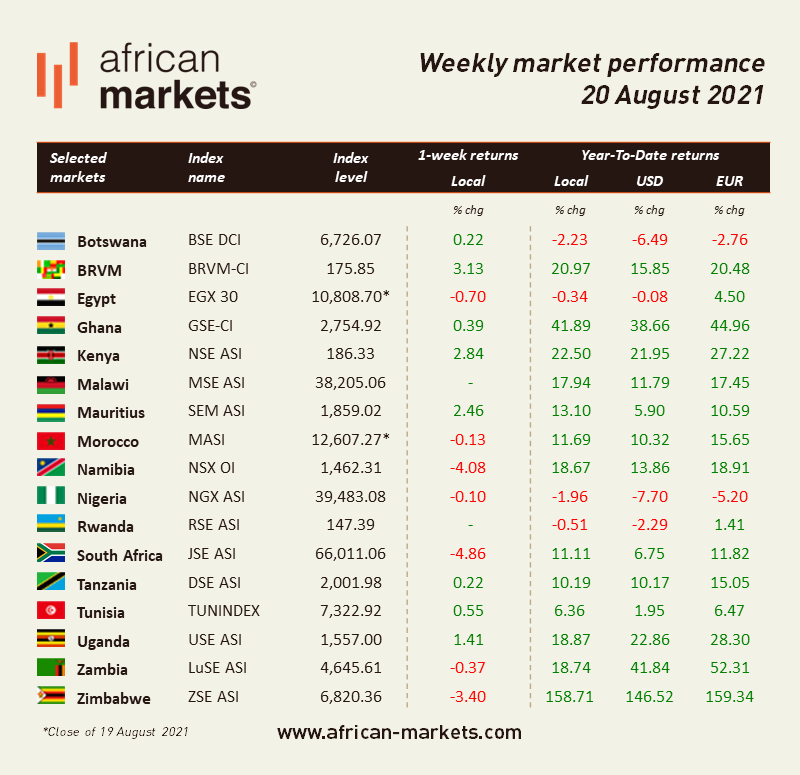

The sentiment was mixed on African equity markets this week. Among the 17 markets we cover, nine advanced while six retreated mildly and two remained flat. The BRVM led the pack as equities in Abidjan gained 3.13%. Conversely, the Johannesburg Stock Exchange was the laggard. South African equities dropped 4.86% this week, the most on the continent.

West Africa

BRVM – Bulls set the tone in Abidjan this week, helping equities advance for the seventh week in a row. Overall, the Composite Index jumped 3.13% WoW to close at 175.85. Market activity soared 65% as XOF 407m (USD 0.72m) worth of shares changed hands every day on average compared to XOF 247m the week before. The market is now up 20.97% year-to-date, and the total market capitalisation amounts to XOF 5,292bn (USD 9.44bn). Societe de Limonaderie et Brasseries d’Afrique SA ( SOLIBRA ) is once again one of the top performers this week. Shares in the beverage company jumped another 33.49% and are up 197.01% YTD. The market heavyweight, Sonatel , remained flat at XOF 14,000 on Friday. It is up 3.70% since the start of the year.

NGX – Equities in Lagos cooled down this week. The NGX ASI, the benchmark index of the Nigerian exchange, shed 0.10% WoW, closing on Friday at 39,483.08. Stocks are now down 1.96% YTD. Activity declined 16% as NGN 2.1bn (USD 5.15m) worth of shares were traded daily on average over the week. The total market capitalisation stands at NGN 20.6tn (USD 50.0bn). Honeywell Flour Mills is the top performer. Shares in the food producer jumped 46.34% and are now up 150% YTD. The market heavyweight, Dangote Cement , closed higher at NGN 249.6 on Friday (up 3.31% WoW).

North Africa

BVC – Moroccan equities cooled down and halted a four-week streak. The MASI shed 0.13% over the last four days. Market activity declined by 14% as MAD 70m (USD 7.8m) worth of shares changed hands every day on average compared to MAD 82m the week before. The total market capitalisation stands at MAD 648.9bn (USD 72.12bn), up 11.69% YTD. M2M Group is the top performer this week. Shares in the technology company that provides processing solutions, securities management, and other electronic services jumped 16.93% and are now up 11.03% YTD. The heavyweight, Maroc Telecom , closed at MAD 139.05 on Friday (down 0.6% WoW). The stock is down 4.10% […]