Overall sentiment on African equity markets was bearish with 10 of the markets we cover losing grounds, 1 remaining flat, and 5 advancing in local terms this week. The downward trend on the BRVM continued for another week. The Western African exchange’s benchmark shed another 0.10% in a thinly traded week that saw XOF 339m (USD 0.63m) worth of shares exchange hands every day on average. The market is down 9.13% year-to-date and the total market capitalization stands at XOF 3,969bn (USD 7.3bn). The top performer this week is Nestle Cote d’Ivoire. The stock soared another 27.91% over the 5-day period and is up 71.88% since the beginning of the year. On the other end, the market heavyweight, Sonatel, closed the week at XOF 11,500. Shares in the telecom operator are down 14.81% year-to-date.

The Egyptian market had another positive week. The EGX 30 advanced 0.69% and closed at 11,525.25 points. Average daily turnover stood at EGP 1.49bn (USD 94m) and the total market capitalization amounts at EGP 689.6bn (USD 43.9bn). The benchmark index is up 6.27% so far this year. Notable performers this week include the investment conglomerate, Raya Holding Company , the real estate developer, Arab Real Estate Investment Co, and the trader of fertilizer and other agricultural chemicals, Samad Misr EGYFERT . The counters jumped by 49.16%, 36.03%, and 26.27% over the week, respectively.

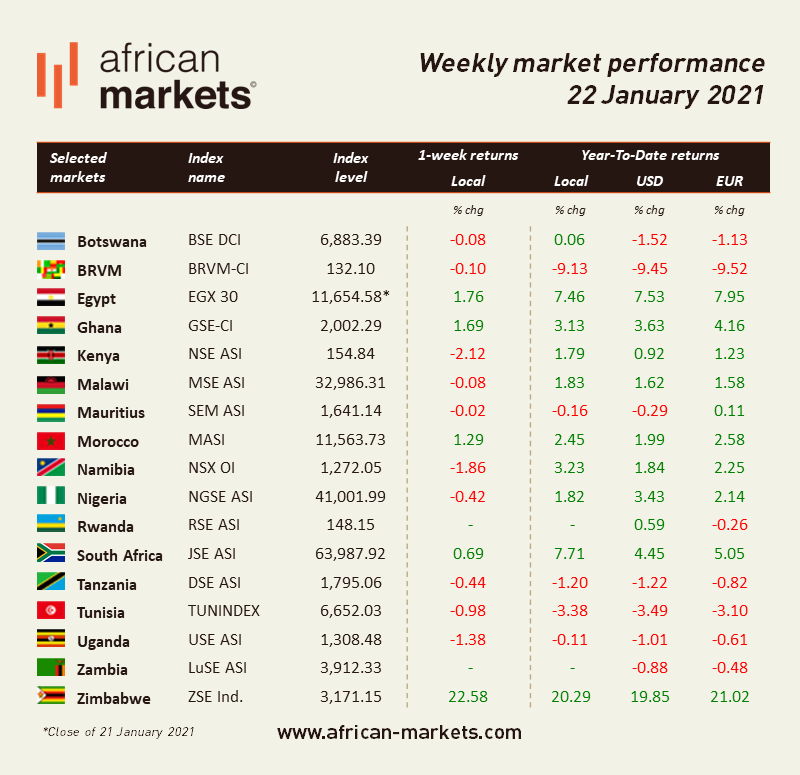

South African equities continued their bull run. The JSE ASI added another 0.69% and ended the week at 63,987.92, getting closer to the 64,000 level. The benchmark index is up 7.71% so far this year. Cartrack, the tech company specialized in vehicle tracking systems, is the top performer this week. The stock skyrocketed 55.48% as the company released strong quarterly results for the 9 months to November 2020. Subscriptions revenues were up 18% year-on-year and profit after tax jumped 20%. The company announced earlier this month its intention to list on the Nasdaq in the US.

Kenyan equities dropped this week. The Nairobi Securities Exchange’s benchmark index lost 2.12% over the week. Average daily turnover stood at KES 530m (USD 4.8m) and the total market amounts to KES 2,378bn (USD 21bn). The market is still up 1.79% year-to-date. The top performer this week is the logistics company Express Kenya. The stocks jumped 12.69%. Safaricom’s performance is less flamboyant. Nonetheless, the telecom operator’s stocks closed at KES 35.55, up 3.80% this year.

Morrocan equities […]