The cryptocurrency Bitcoin has become a center of excitement, mystery, and controversy. Boosters have viewed it as an investment opportunity, a financial innovation, and a rival to state-controlled currencies; skeptics think it is an energy-wasting market bubble.

MIT economist Robert Townsend sees things differently. To Townsend, Bitcoin, for all its novelty, is part of a larger family of financial innovations, known as “distributed ledgers,” which allow people to perform financial activities without requiring a central authority to keep a master copy of those transactions and while minimizing the need for individuals to trust each other.

Functionally, distributed ledgers can be applied to payments, financial accounts, escrow mechanisms, and contracts. These tools have evolved globally while receiving comparatively little attention — even though some of the tools are part of Bitcoin.

“Almost everyone has heard of Bitcoin, and likewise, they have opinions about it,” Townsend observes. “It’s quite a politicized issue. But a lot of its technologies were pre-existing. They got put together in a rather interesting and complicated way in Bitcoin. But the idea of having a common ledger implemented by consensus on transactions, that was not unique to Bitcoin; that predated it.”

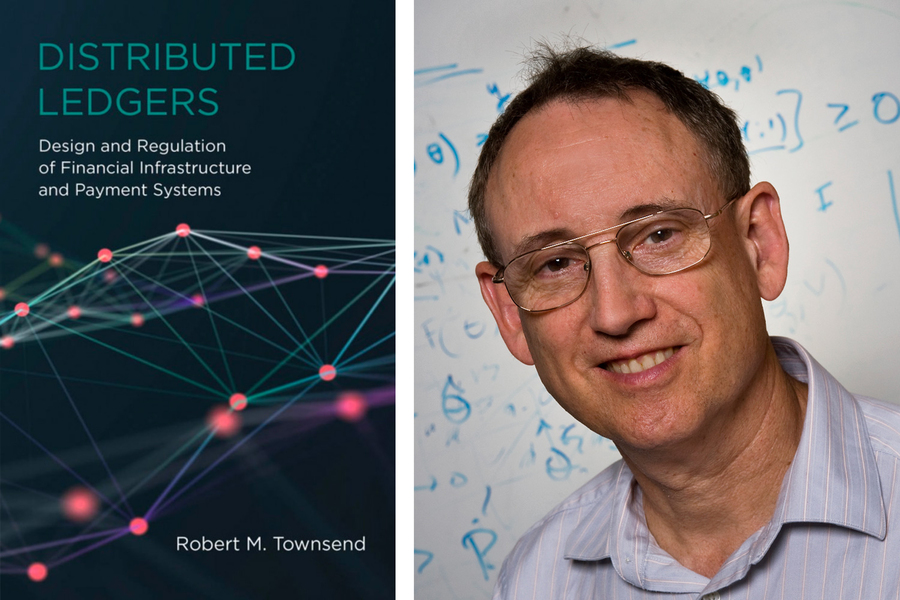

Now Townsend has written a book, “Distributed Ledgers: Design and Regulation of Financial Infrastructure and Payment Systems,” published this month by the MIT Press, in which he surveys these tools and analyzes their usefulness. Overall, Townsend writes, distributed ledgers “have the potential to transform economic organization and financial structure,” especially in areas of the world lacking financial institutions — although not only in those places.

For instance, shipping giant Maersk has combined with IBM to build a distributed ledger system for its business. The Reserve Bank of India’s TReDS platform lets merchants directly receive trade receivables (money owed to them) through distributed ledger principles. And numerous platforms now facilitate money transfers across national borders.

“These things are increasingly being used quite a lot,” Townsend says. “On the other hand, there is [also] a lot of exaggeration and hype and outright failure.”

Up close in Thailand

The book’s origins start with the Townsend Thai Project, a 20-year research effort Townsend oversaw, starting in the 1990s, which collected monthly financial data from hundreds of households in several provinces. This helped Townsend see the potential of distributed ledgers, since many Thai people and communities lack easy access to financial institutions.

“People tend to react relative to what they have in their own country,” Townsend says. “In […]