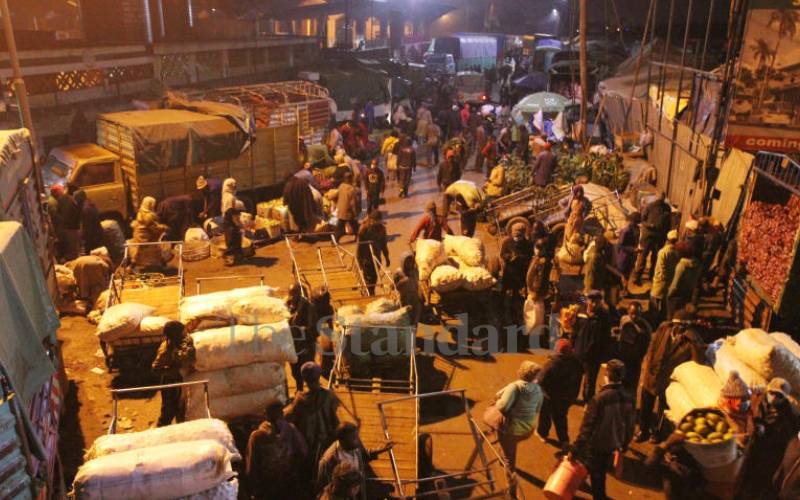

Traders at Marikiti market, Nairobi. [Elvis Ogina, Standard] Financial sector players, including banks, Saccos, insurers and digital lenders expect a continued rebound in 2022 pegged on improving economic activities amid persisting Covid-19 infections.

Kenya will in March mark two years since the pandemic struck the country. But CEOs and regulators in the financial sector say the sector has turned the corner.

For banks, their results validate their point that while 2020 was a survival year and 2021 a recovery one, the New Year presents an opportunity to consolidate the gains. READ MORE

Banks’ seven-month profit before tax to July had already surpassed the full-year performance for 2020, with the growth trend persisting up to September.

Kenya Bankers Association (KBA) Chief Executive Habil Olaka says the rebound during the year was in line with the clearing economic hardships among businesses and individuals.

“In 2021, not only did provisions for defaults go down because the future was looking better than in 2020, but also a number of provisions were reversed. The accounts have been recovering from Covid-19,” he said.

With non-performing loans dropping and businesses in sectors such as agriculture, manufacturing and real estate stepping up their activities, the banking sector believes it will be at the forefront in taking the economy to the next level.

Mr Olaka said banks have now positioned themselves to support the growth segments of the economy, such as micro, small and medium-sized enterprises.

“Banks provide the oil that lubricates the moving parts of the economy. So as the economy continues to pick up, banks can provide the necessary liquidity. This coming 2022 should be a much better year compared to 2021,” he said.

For digital lenders, it has been a year of mixed reactions. They have spent the whole year outside credit reference bureaus (CRBs) after the Central Bank of Kenya (CBK) ejected them in April 2019.

In the absence of CRB, digital lenders said the motivation for customers to repay loans dropped, forcing them to cut lending.But they are closing the year on a good note after CBK published draft Digital Credit Providers Regulations, 2021 that will, among other things, usher them back to CRB platforms.“We started the year unregulated, but we are closing on a positive note. We are excited about the prospects of working together with the Data Commissioner and CBK next year,” said Digital Lenders Association of Kenya Chairman Kevin Mutiso.“I expect a significant increase in lending to individuals and […]