Equity Group Holdings Plc has signed a Kshs 16.5 Billion loan facility with the European Investment Bank (EIB) and the European Union (EU) in its continued commitment to strategically walk with MSMEs during the three years the COVID-19 pandemic is expected to adversely affect the business operating environment as a result of the adoption of COVID-19 coping and containment measures.

Equity Group, the EIB, and the EU chose to have the loan facility in Kenya Shillings to match the operating currency of SME businesses and eliminate the risk of foreign exchange while the EUR 20 million grant allows capacity building on the borrowing clients to derisk lowering the risk of default and hence allowing affordability by the adoption of low-risk priced interest rates.

In response to the COVID-19 crisis, Equity launched an offensive and defensive approach to support customers to sustain themselves while innovating alongside MSMEs who are leveraging on the opportunities that have presented within the crisis. The Group committed to loan repayment accommodation for up to 45% of the customers whose cashflows and operation cycle were deemed likely to be negatively impacted during the COVID-19 pandemic. Equity made the prudent decision to ensure cashflow was not impaired and in its third quarter 2020 results, Equity reported a 30% growth in its loan book in support of its customers who saw opportunities of green shoots and diversifications in the COVID-19 environment. Most of the new opportunities funded were in manufacturing of PPE’s, logistics, online businesses, agro-processing, fast moving consumer goods and agriculture value chains.

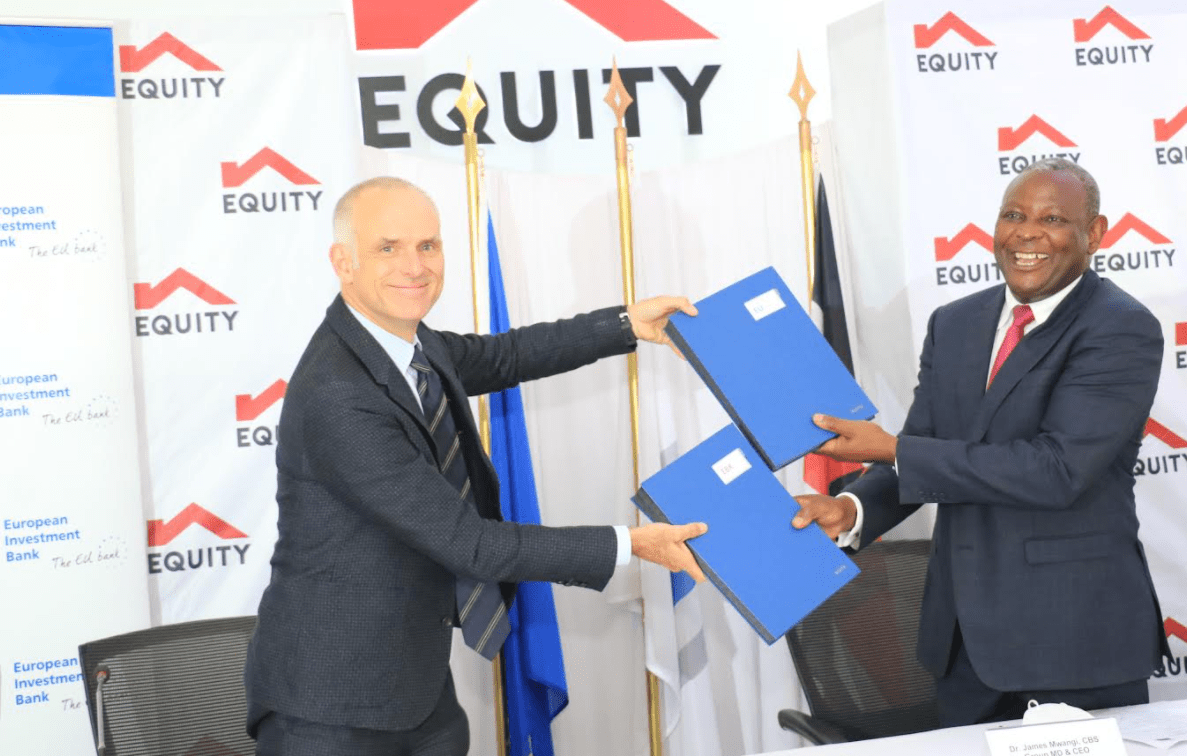

In announcing the latest loan facility, Dr. James Mwangi, Managing Director and CEO of Equity Group Holdings Plc stated, “The impact of the COVID-19 pandemic started as a health crisis, which quickly became an economic and humanitarian crisis that has seen almost 40% of Kenyan small business owners negatively affected by the great economic mechanism of coping, managing, mitigating and containing COVID-19 during the shutdown in business. Equity’s goal is to keep the lights of the economy on by ensuring firms and businesses remain open, sustain employment and by keeping markets open for goods and services thus facilitating a quick recovery of businesses and the economy at large. This funding adds oxygen to the real economy through funding of enterprises under the `Young Africa Works’ Program where Equity, Mastercard Foundation and the Government of Kenya are working to create 5 million jobs for women and young people […]