HKEX ended July as the world’s largest exchange operator by market capitalisation.

The top 5 exchanges by market capitalisation at end July were:

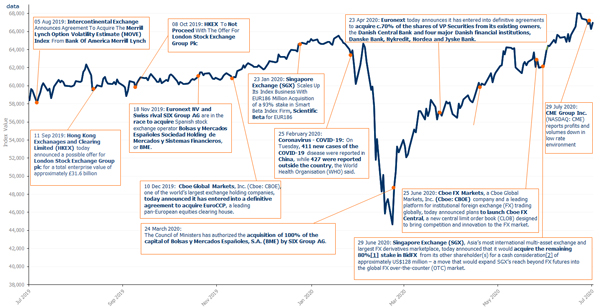

Shares in the world’s largest exchange operating groups rose by 6.6% in July, with all but 7 of the 30 constituents of the FTSE Mondo Visione Exchanges Index being in positive territory, and the index, which aims to reflect market sentiment and is a key indicator of exchanges performance, setting a new closing all-time high of 68,056.41 on 21 July, 2020 and closing at 66,969.58 on 31 July 2020.

The best performer by capital returns in US dollars was Multi Commodity Exchange of India with a 32.6 per cent increase in share price from 30 June 2020 to 31 July 2020. The next best performer was Bursa Malaysia with a 29 per cent increase, followed by Brazil’s B3 SA with a 21.5 per cent increase over the same period.

The worst performer by capital returns in US dollars was Kenya’s Nairobi Securities Exchange with a 13.1 per cent decrease in share price from 30 June 2020 to 31 July 2020. This was followed by Philippine Stock Exchange with a 6.9 per cent decline and Cboe Global Markets with a 6 per cent decrease over the same period.

Herbie Skeete, Managing Director, Mondo Visione and Co-founder of the Index said: "The stock of Multi Commodity Exchange of India has risen to new highs on the back of volumes of gold and silver futures. Spot gold rose USD10.50, or 0.5 percent, to USD1,969.69 an ounce as the price of gold inched towards the USD2,000 milestone. MCX has received regulatory clearance to launch index futures in bullion and metal. MCX iComdex bullion index futures and MCX iComdex base metals index futures will be launched after mock trading is completed. In mid-August." Click here to download July’s performance report.

Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD) Monthly FTSE Mondo Visione Exchanges Index Performance (Capital Return, USD) July 2014 3.1% August 2014 2.3% September 2014 -3.6% October 2014 2.8% November 2014 2.5% December 2014 -0.5% January 2015 -1.0% February 2015 8.5% March 2015 0.0% April 2015 10.7% May 2015 0.1% June 2015 -3.2% July 2015 -2.7% August 2015 -5.3% September 2015 -2.1% October 2015 7.6% November 2015 0.4% December 2015 -2.2% January 2016 -4,7% February 2016 -0.7% March 2016 6.7% April 2016 0.4% May 2016 1.8% June 2016 -2.2% July 2016 5.3% August […]