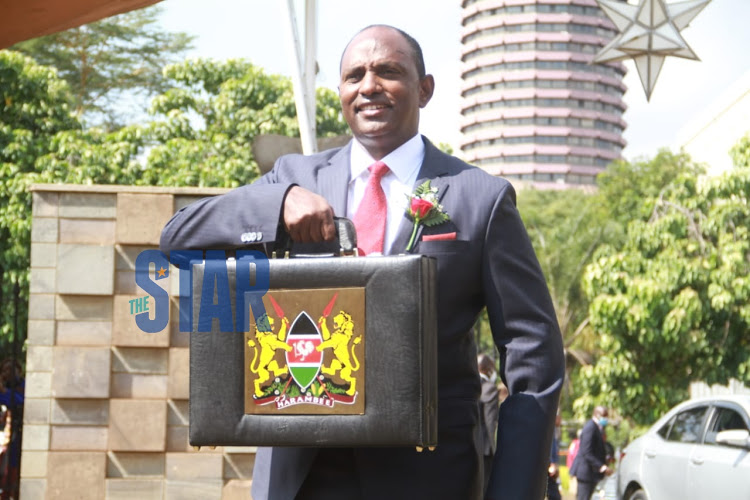

Treasury Cabinet Secretary Ukur Yatani outside Pariament Buildings on June 11. The Kenyan government has earmarked 18 state agencies for restructuring as part of IMF’s condition for the $2.34 billion loans granted in April.

The National Treasury on Thursday added nine more state agencies to the initial nine slated for privatisation.

It said this was after a thorough financial assessment that revealed that the enterprises had an outstanding Sh170 billion in government-guaranteed debt as of December 31 last year.

Kenya Airways, Kenya Airports Authority, Kenya Railways Corporation, Kenya Power, Kengen, Kenya Ports Authority, and three public universities were in the initial list.

The new additions include Kenya Broadcasting Corporation, Postal Corporation of Kenya, Athi Water Works Development Agency and Kenya National Examinations Council.

Others are Kenya Wildlife Service, Kenya Post Office Savings Bank, Kenyatta National Hospital and E.A. Portland Cement.

According to IMF, the government might use an additional Sh65 billion to bail out cash-strapped parastatals in the current financial year.

”Under the 38-month programme, the government intends to restructure some of the big SOEs, in a bid to make them efficient as a cash-strapped Treasury looks to reduce its fiscal risks,” the international lender said in April.

In its assessment, the exchequer grouped those agencies into three categories:- large service providers, social service providers, and insolvent or loss-making.

The evaluation broadly assessed agencies’ projected cash flow for the period between 2021/22 to 2024/25, incorporating sales and liability structures that have the potential to crystalise the national budget.

The analysis established that the state agencies in question have an estimated liquidity gap of Sh382 billion over the next five years.”The estimated liquidity gap reflects the sizeable financial woes in the state corporations sector. If these challenges are not addressed, they may turn into a significant fiscal risk to Kenya’s economy,” Treasury said.It tabulated the financial risk for those institutions to Sh70 billion per annum, saying that the danger can only be dealt with via a multi-faceted approach including revenue-enhancing, expenditure cuts and sealing of revenue leakages.Some of the state corporations listed as loss-making include KBC, Postal Corporation of Kenya, E.Africa Portland Cement and Post Bank.Those considered to be unprofitable are Kenya Power and Kenya Railways Corporation.Kenya Port Authority, KenGen and Kenya Pipeline were found to be highly profitable while the rest are operating below costs recovery.The exchequer said it was reviewing business models and operating environment of the affected agencies with a view of proposing solutions including combining new […]