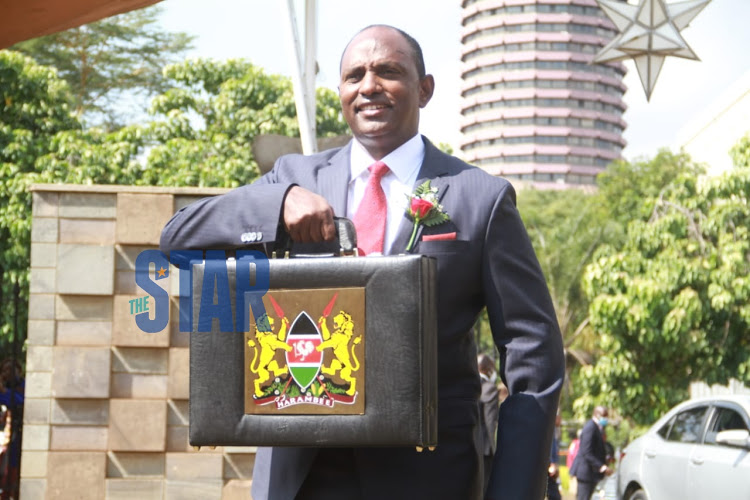

Treasury Cabinet Secretary Ukur Yatani outside Pariament Buildings on June 11. Eric Mugo, operates a food business in Westlands, his ‘kibanda’ (booth) serves many Kenyans in the busy area operating from 8am to 6pm.

For daily operational capital, considering some clients eat on credit, he depends on mobile loans from Safaricom’s Fuliza to keep his business going running.

Daily he borrows at least Sh1,000 from the digital lender as he clears the previous loans. This has been his survival mode but with the new taxes in the Finance bill 2021 he says the cost of credit is too high.

In the bill which took effect from July 1, a 20 per cent tax on fees and commissions earned on bank credit is charged.

Following this new law, Safaricom wrote to its customers saying that starting July 6, 2021 Fuliza daily fees will include 20 per cent Excise Duty.

The new taxes mean that for every Sh1,000 Mugo borrows, he will have to pay Sh25 tax, this will also be factored in when repaying the loans which charges a one per cent interest daily.

“These taxes have become too many, what profits will I be making in my business if I have to pay back so much more,” said a frustrated Mugo.

Mugo added that the new taxes could force him to raise the cost of food, which could burden his clients who visit his outlet for affordable meals.

“I know times are hard from my clients. Naelewa (I understand), but I will have to factor in the cost of doing business so as to ensure I’m getting something small,” said Mugo.

Mugo’s sentiments reflects that of other Kenyans who use digital loans to keep their businesses going or meet other needs.

“I borrow because I don’t have money yet now the government wants to add interest on what I get, this life is becoming too hard,” said Stella Mutio, a university student.On Safaricom’s twitter handle, a customer by the name Annan asked the telco not to call him dear when delivering the increased cost on Fuliza, due to frustration. “20 per cent excise duty on Fuliza compounded with all the other excise duties, (airtime etc) will hit the ordinary ‘wanjiku hard, why isn’t the government understanding Kenyans,” tweeted economist, Morris Aron.The excise duty also reflects on Safaricom’s M-Shwari powered by KCB Bank.Before July 1, if you took a loan of Sh1,000. The loan fees would be 7.5 per cent […]