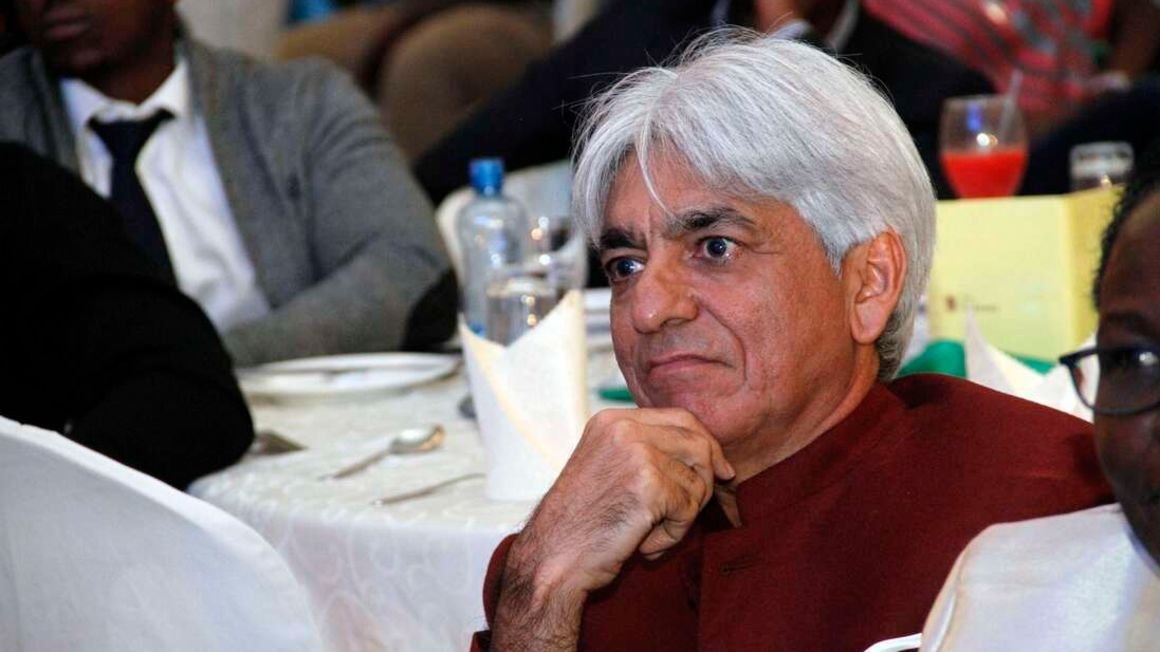

Former WPP Scangroup CEO Bharat Thakrar. FILE PHOTO | NMG WPP Scangroup has closed an investigation against its former chief executive, Bharat Thakrar, without finding incriminating evidence, raising questions about the reliability of the information it used to push out the company’s founder.

The marketing services firm has published its financial statements for the year ended December — which has delayed by four months — revealing that its assets and profitability were not affected by fraud.

Mr Thakrar and former financial officer Satyabrata Das were suspended on February 19 for unspecified reasons and later resigned from the company.

Scangroup subsequently informed shareholders that its auditors needed more time to determine if the investigations against its former executives would reveal issues large enough to alter its financial statements, indicating that they were suspended over financial misconduct.

The Nairobi Securities Exchange-listed firm now says that nothing substantial was uncovered in the probe.

“The investigation did not identify items of a material nature that required adjustment to the results of the company or the group for the year ended December 31, 2020 or to the balance sheet at that date,” the company said in a statement.

The announcement of the probe had sent jitters among the company’s shareholders, sending the stock down to record lows of Sh3.6 as of Tuesday’s trading session.

The company’s external auditors said there was difficulty in obtaining financial information about five foreign associates of Scangroup but added that the minority investments were fully provided for years ago. The company, however, made better disclosures in its financial statements by segregating interest income and interest expense.

Mr Thakrar has not commented on the saga since leaving the company. Sources familiar with the matter told the Business Daily that Mr Thakrar and representatives of the company’s majority shareholder, London-based WPP Plc, had fallen out over management and strategy, including capital allocation decisions.

Scangroup reported a net profit of Sh469.2 million in the year ended December 2020, an 8.6 percent rise from Sh431.9 million the year before. The performance was largely derived from a Sh2.2 billion net gain from the disposal of the subsidiary Kantar Africa.

Excluding that transaction, Scangroup would have made a loss as indicated by a Sh1.7 billion loss from continuing operations. The company did not declare a dividend. It had made a record payout of Sh8 per share for the previous year.