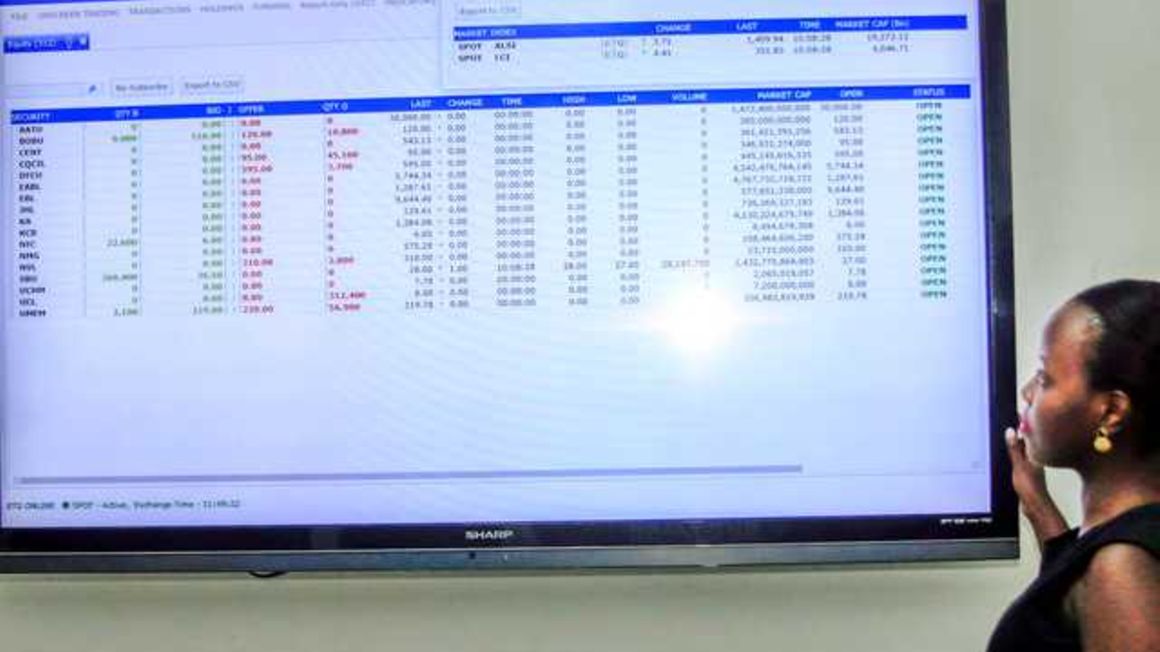

Airtel Uganda is racing against time to list 20 percent of its shares on the Uganda Securities Exchange (USE) before a June 30 deadline, even as players wonder if the market is ready for another initial public offering so soon after MTN Uganda suffered an under-subscription late last year. PHOTO | COURTESY Airtel Uganda is racing against time to list 20 percent of its shares on the Uganda Securities Exchange (USE) before a June 30 deadline, even as players wonder if the market is ready for another initial public offering so soon after MTN Uganda suffered an under-subscription late last year.

MTN Uganda’s market value has plunged weeks after it started trading but Uganda Capital Markets Authority (CMA) Chief Executive Keith Kalyegira said the two telecoms have different fundamentals.

Kalyegira told The EastAfrican that consultations to list Airtel Uganda shares on the bourse have started, but he added that “inquiries with Airtel are not formal,” which means the second-largest telecommunication company in Uganda is yet to submit its draft prospectus for scrutiny.

Stockbrokers in Kampala have intimated that it is in the interest of the CMA to facilitate Airtel Uganda’s listing as it will expedite categorisation of the Uganda bourse as a frontier market in the Morgan Stanley Capital International (MSCI) index.

In Africa, the Nairobi Securities Exchange, the Stock Exchange of Mauritius and the Nigerian Stock Exchange are among bourses that fall in the frontier category of MSCI. Growth ambition

On several occasions, Kalyegira has maintained that the frontier market status puts Uganda on the radar of large institutional investors that currently ignore smaller and less liquid exchanges.

Kalyegira said the USE needs at least two companies with a net worth of $700 million on its listing and the telecom sector is betting on Airtel’s listing, although he maintains its value is unknown.

The Uganda National Broadband Policy (2018) compels telecoms to float 20 percent of their shares on the Uganda Securities Exchange. Airtel’s National Telecom Operators (NTO) Licence became effective July 1, 2020.

The challenge, however, is that MTN stock performance has been disappointing to both old and new investors. Its Uganda share price has plunged to a 10 percent low, devaluing the company by more than $134.45 million.

Uganda capital market players attribute the plunge to retail investors who rushed to liquidate their holding to raise cash, specifically to pay school fees. Schools in Uganda reopened this month after a two-year pandemic break when […]