Foreign Transactions In The Stock Market Drop By N66.24bn

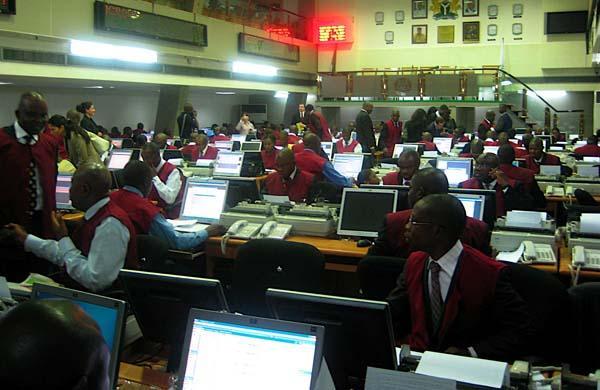

The Nigerian Stock Exchange recorded a decline of N66.24bn in foreign portfolio transactions last month amid political uncertainties and rise in interest rates in the United States.

The July 2018 Domestic and Foreign Portfolio Participation in Equity Trading report, which was released on Monday, showed that total transactions at the nation’s bourse reduced by 22.21 per cent from N187.78bn in June to N146.07bn in July.

It showed that the cumulative transactions from January to July 2018 increased by 54.38 per cent to N1.743tn from N1.129tn recorded in the same period last year.

Domestic investors outperformed foreign investors by 50.48 per cent in July as total domestic transactions increased by 28.72 per cent from N85.38bn in June to N109.9bn in July.

The report read in part, “The domestic transactions were largely driven by the 55.48 per cent increase in the retail domestic participation, which recorded N29.12bn in June 2018 and N65.42bn in July 2018.

“There was a significant decrease of 64.68 per cent in total foreign transactions from N102.41bn in June 2018 to N36.17bn in July 2018. Foreign outflows reduced by 69.99 per cent from N54.45bn to N16.34bn while foreign inflows also reduced by 58.65 per cent from N47.96bn to N19.83bn over the same period.”

The nation’s equities market also depreciated by N42bn at the close of trading on Monday after 14 stocks recorded price declines.

The NSE All-Share Index shed 0.32 per cent to settle at 35,311.36 basis points, while the market capitalisation of listed equities fell to N12.891tn from N12.933tn on Friday.

The market closed in a southward direction, shedding 0.32 per cent to reverse the positive sentiment it closed in the last two trading sessions.

A total of 178.810 million stocks valued at N2.020bn exchanged hands in 2,981 deals.The loss was aided by the negative performance of Dangote Cement, Dangote Flour, UAC Nigeria Plc, and 10 others, analysts at GTI Securities Limited said.First Aluminium Nigeria Plc, Ikeja Hotel Plc, Universal Insurance Company Plc, Japaul Oil and Maritime Services Plc, and Secure Electronic Technology Plc, which declined by 10 per cent, 9.68 per cent, 9.09 per cent, 7.69 per cent, and 4.76 per cent, respectively, emerged the top five losers at the end of trading on Monday.Similarly, activity level waned as volume and value traded declined by 66.11 per cent and 55.37 per cent to 178.810 million units and N2.020bn, respectively.Sector performance was poor as all indices either depreciated […]