By JEROME USHAKANG

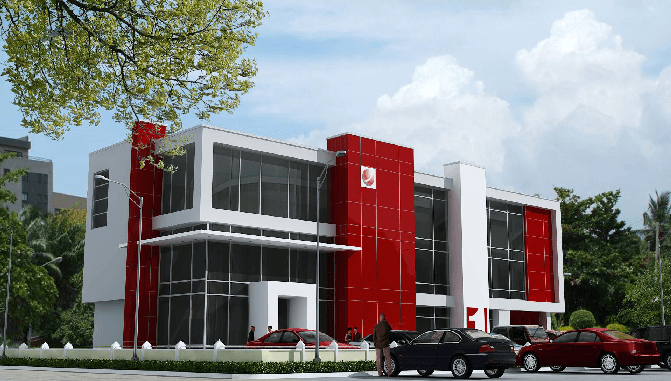

Sterling Bank Plc, is desirous to shelve its low profile image as the only commercial bank in Nigeria that has paid two kobo dividend per share to its shareholders in recent times.

The bank which used to lag behind its peers in the banking industry seems to have woken up as it is planning to migrate from the tail region of the sector towards the head in an attempt to raise its financial status.

The Oracle checks revealed that Sterling bank has planned to focus its lending on five key sectors. These are Health, Education, Agriculture, Renewable Energy and Transport.

It has also launched I-invest, an application that enables consumers to buy treasury bills and has also increased its social media presence, a strategy which should yield benefits if it remains consistent.

However, Sterling Bank is at the moment trading far below the average price to earnings ratio on the Nigerian Stock Exchange (NSE). It is currently trading at a price to earnings ratio of 3.39 times earnings. Start your free trial. Ad Everyone needs a website. Make yours with

Squarespace and stand out. Try it for free. Squarespace Learn more At the time of filling this report, the share price of Sterling Bank closed at N1.30 kobo per share. The peak price of the stock during 2017 financial year was N2.42 kobo while it’s lowest stood at N1.13 kobo with Year-to- Date at 20.37 percent and one year return at 26.55 percent.

In a nutshell, the possibility of a rally in the bank’s share price is quite low, as the Nigerian Stock Exchange has been in a bearish slump since the last few weeks.

Therefore, shareholders or prospective investors expecting a bumper dividend may be disappointed. Besides, the bank has planned to raise additional capital within the year.

Meanwhile, results for the half year ended June 30, 2018 showed that interest income increased to N62 billion in 2018, from N50 billion in 2017. Profit before tax rose from N4.3 billion in 2017 to N6.3 billion in 2018. Profit after tax grew from N3.8 billion in 2017 to N6.2 billion in 2018.

For the banking sector, results have largely been flat year on year as revaluation gains have disappeared due to a stable exchange rate, backed by robust foreign exchange reserves and a positive outlook for current oil prices.

The rebound in the bank’s results have been largely due to increased earnings from fees and […]