Traditional dividend payers such as KCB, Equity, Co-operative Bank of Kenya and NCBA are all promising to distribute part of the profits to shareholders. Banks needed just seven months this year to earn the profits they made the whole of last year, new data shows. And now they are promising shareholders bumper dividends as the […]

Tag: XNAI_KCB

KCB acquisition of Tanzanian bank flops

KCB Group has cancelled its plan to acquire a Tanzanian lender from London-listed Atlas Mara Limited, citing regulatory hurdles. KCB in late November 2020 announced that it would acquire 62.06 percent stake in Banque Populaire Du Rwanda (BPR) and 100 percent stake in African Banking Corporation Tanzania Limited (BancABC). The lender, which already has a […]

Banks’ assets up over Sh500bn in Q3 on high deposits – CBK

Coop Bank Group managing director Gideon Muriuki at a past event. Assets of banks operating in Kenya grew by half a trillion shillings in three months from June to September 30. According to Central Bank of Kenya’s third quarter Commercial Bank Credit Officer Survey covering 39 banks, aggregate balance sheet increased by 2.5 per cent […]

KCB acquisition of Tanzanian bank flops

KCB Group CEO Joshua Oigara (right) Chairman Andrew Kairu (centre) and Group CFO Lawrence Kimathi during the release of the full-year result. PHOTO | POOL KCB Group has cancelled its plan to acquire a Tanzanian lender from London-listed Atlas Mara Limited, citing regulatory hurdles. K CB in late November 2020 announced that it would acquire […]

Sh27bn bad loan cut helps drive bank profits

Top banks saved up to Sh27.2 billion in the nine months to September on lower costs of handling defaults as borrowers resumed making payments following months of a freeze. The eight tier-one lenders reduced their loan loss provisioning costs by up to 39 percent, underlining the supernormal profits posted by most of them. KCB Bank […]

KCB To Buy Out Minority Shareholders In Rwanda Unit

Minority shareholders in Rwanda’s KCB unit are scheduled to be bought out by its parent bank. According to details, KCB plans to acquire the 24% stake owned by minority investors in its Rwandan subsidiary Banque Populaire du Rwanda Plc (BPR) next year. The Kenyan banking multinational recently bought a 62% stake from London-based Atlas Mara […]

East Africa: A region in debt as top banks record $125m in bad loans

Co-operative Bank had the highest volume of non-performing loans. FILE PHOTO | COURTESY East Africa’s top retail banks booked more than $125 million of bad loans in the nine months to September this year, as borrowers struggled to repay their loans following the expiry of a 12-month loan repayment relief programme for customers adversely impacted […]

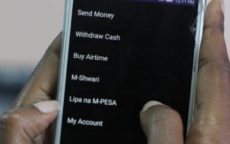

Move over M-Shwari and KCB M-Pesa, Fuliza now the new lending king

The Fuliza overdraft service transacts more than Sh1.2 billion daily. Safaricom’s overdraft facility, Fuliza, has taken less than three years to capture the digital lending market. But the telco’s climb to the pinnacle of the market segment has been anything but smooth. It started with M-Kesho—the ill-fated product launched by the mobile service provider in […]

Tanzania : NMB share increase pulls up DSE indices

NMB Bank has continued to rise and shine at the bourse since the ice broke two weeks, thanks to its outstanding performance in the first nine months of the year. The bank, one of the largest in the land, share price increased by 8.51 per cent to close last week at 2,040/- and assisting pushing […]

National Bank delisted from trading at the NSE

An investor looks at the digital board at the Nairobi Stock Exchange(NSE)/FILE The Capital Markets Authority has approved the de-listing of the National Bank of Kenya from the Nairobi Securities Exchange. This follows the successful takeover of 100 per cent shareholding of NBK by KCB Group and NBK shareholders approval. “Notice is hereby given on […]