Equity Group has announced a 98% growth in profits during the last 6 months to Ksh. 17.9 billion up from Ksh. 9.1 billion recorded in a similar period last year.

This growth has been attributed to the defensive and offensive strategy adopted by the Group at the onset of the COVID-19 pandemic to create resilience, agility and recovery. The 6 countries within which the Group operates have projected strong GDP growth rates. These are Kenya at 7.6%, Uganda 6.3%, Rwanda 5.7%, South Sudan 5.3%, DRC 3.8% and Tanzania 2.7%.

The aggressive growth strategy effected by the Group resulted into a 33% growth in topline Total Income to Kshs.51.6 billion up from Ksh. 38.7 billon driven by a 26% growth in Net Interest Income of Ksh. 31.2 billion up from Ksh. 24.6 billion and a 45% growth in Non-Funded Income of fees, commission and transactions to Ksh. 20.4 billion up from Ksh. 14.1 billion.

The strategy saw deposits register a 51% growth to Ksh. 820.3 billion up from Ksh. 543.9 billion, while long term borrowed funds grew by 78% to Ksh. 102.3 billion up from Ksh. 57.6 billion. Net Loans and advances grew by 29% to Ksh. 504.8 billion up from Ksh. 391.6 billion, while investment in Government securities grew by 46% to Ksh. 315.5 billion up from Ksh. 216.4 billion resulting in 50% growth in Total Assets to Ksh. 1.12 trillion up from Ksh. 746.5 billion.

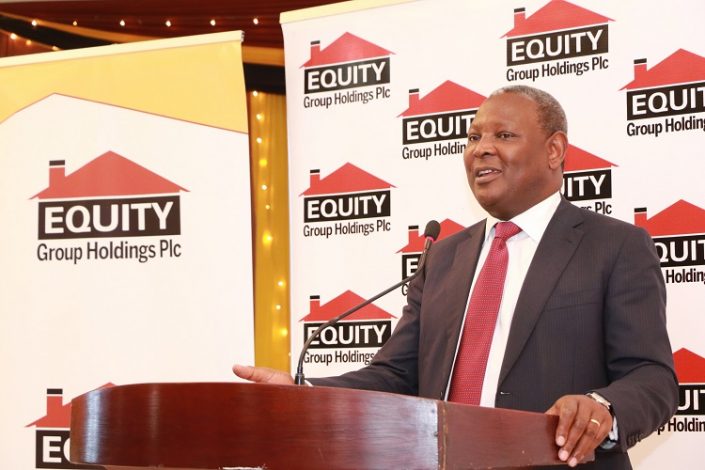

Presenting the financial results, Equity Group CEO and Chairman Dr. James Mwangi said, “The strong capital and liquidity ratios have positioned the Group well for continued execution of the offensive strategy particularly in light of improving asset quality and operational efficiency and an improving operating environment.

The regional approach with Kenya now being only 60% of the Group balance sheet mitigates national shocks and sovereign risks. Group efficiencies shared with the subsidiaries are quickly translating regional growth to value creative growth, with majority of the regional subsidiaries Return on Average Equity being higher than their cost of capital.

“We have witnessed resilience and recovery of businesses with digital banking transactions growing by 57.6% to 606.9 billion up from 385.2 billion transactions same period the previous year. The value of the digital transactions increased 111.3% to Kshs.2.5 trillion up from Kshs.1.16 trillion for a corresponding period the previous year,” added Dr. Mwangi.

The half-year earnings are equivalent to 89.5% of the Ksh. 20 billion the group posted in full-year 2020, placing […]