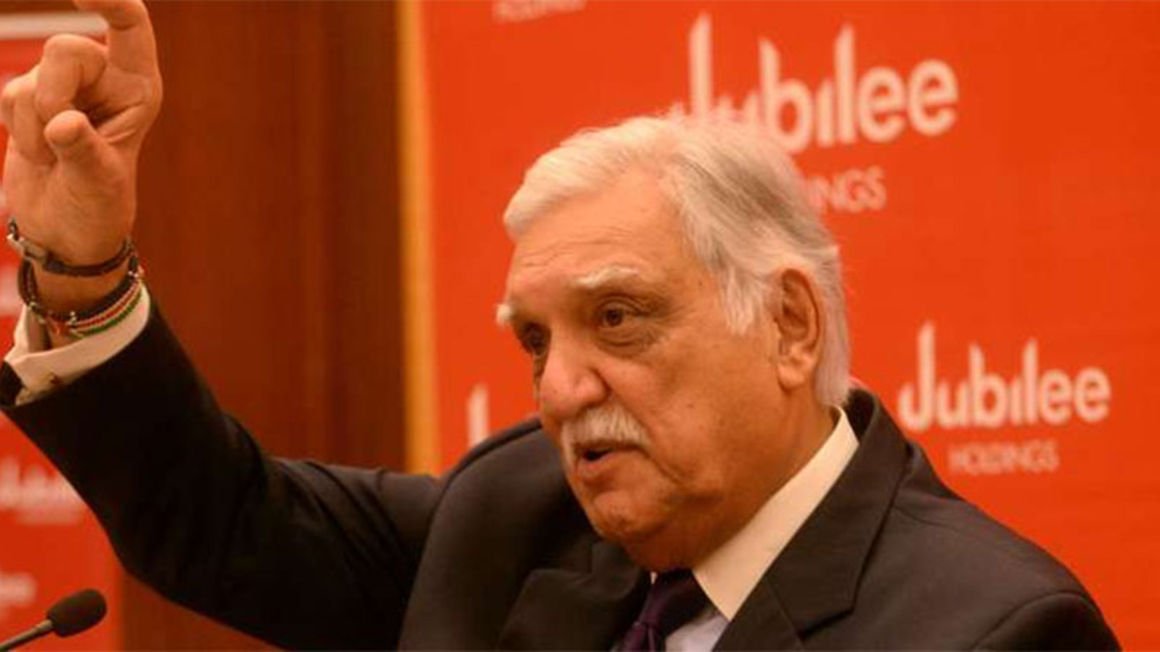

Jubilee board chairman Nizar Juma. FILE PHOTO | NMG Jubilee Holdings says nearly a third of thousands of daily medical insurance claims it receives are tied to fraud, reinforcing the need to deepen investment in technology to avoid losses.

The group, which owns Jubilee Health Insurance—a subsidiary for medical covers—says it has had to digitise the claims filing process and part ways with some hospitals that were supporting fraud.

Jubilee chairman Nizar Juma told investors in Tuesday annual general meeting that the insurer the digital claims process has helped it to detect fraud without delaying the paying of genuine claims.

“We are affected (by fraud) just like all other insurance companies. Particularly in medical insurance, we handle between 6,000 to 8,000 claims a day. At least a third of these claims have got fraudulent content,” said Mr Juma.

“We have had to be extremely vigilant. In some cases, we have had to stop dealing with some hospitals.”

Insurance fraud is a menace to the sector because it reduces the profitability of insurers and inconveniences genuine customers since insurers are sometimes forced into a lengthy process of vetting claims as a way of keeping fraudsters at bay.

Jubilee Health Insurance last year posted Sh682.58 million net profit, marking the first disclosure since being separated from the general insurance entity.

The results, coming in the period Covid-19 disruptions cut the number of hospital visits, helped Jubilee buck the trend in an insurance class where many entities have been returning losses.

Jubilee filings to the Insurance Regulatory Authority (IRA) shows that the health business returned an underwriting profit—the difference between premiums collected and claims paid out—of Sh693.55 million.

Mr Nizar says Jubilee now wants to invest more in artificial intelligence and robotics to support the online onboarding of customers and buying insurance covers.