The date was March 16, 2020, and cases of the novel coronavirus had just begun to spike in Kenya. Following recommendations from the government urging less use of cash as a precaution against the virus, Kenyan banks and mobile money platforms had been forced to become generous, sort of.

These institutions had been “gently urged” to forgo the usual fees on specific mobile money services for 90 days so as to encourage their increased use amid the pandemic . And the companies obliged.

Among other things, it felt like great PR. But that was up until it didn’t, which is how it feels now that Kenyans are gaming the system, as they will likely keep doing for another 6 months. And service providers are counting the cost of the freebie, which was initially billed to last for 3 months but has since been extended to December 2020.

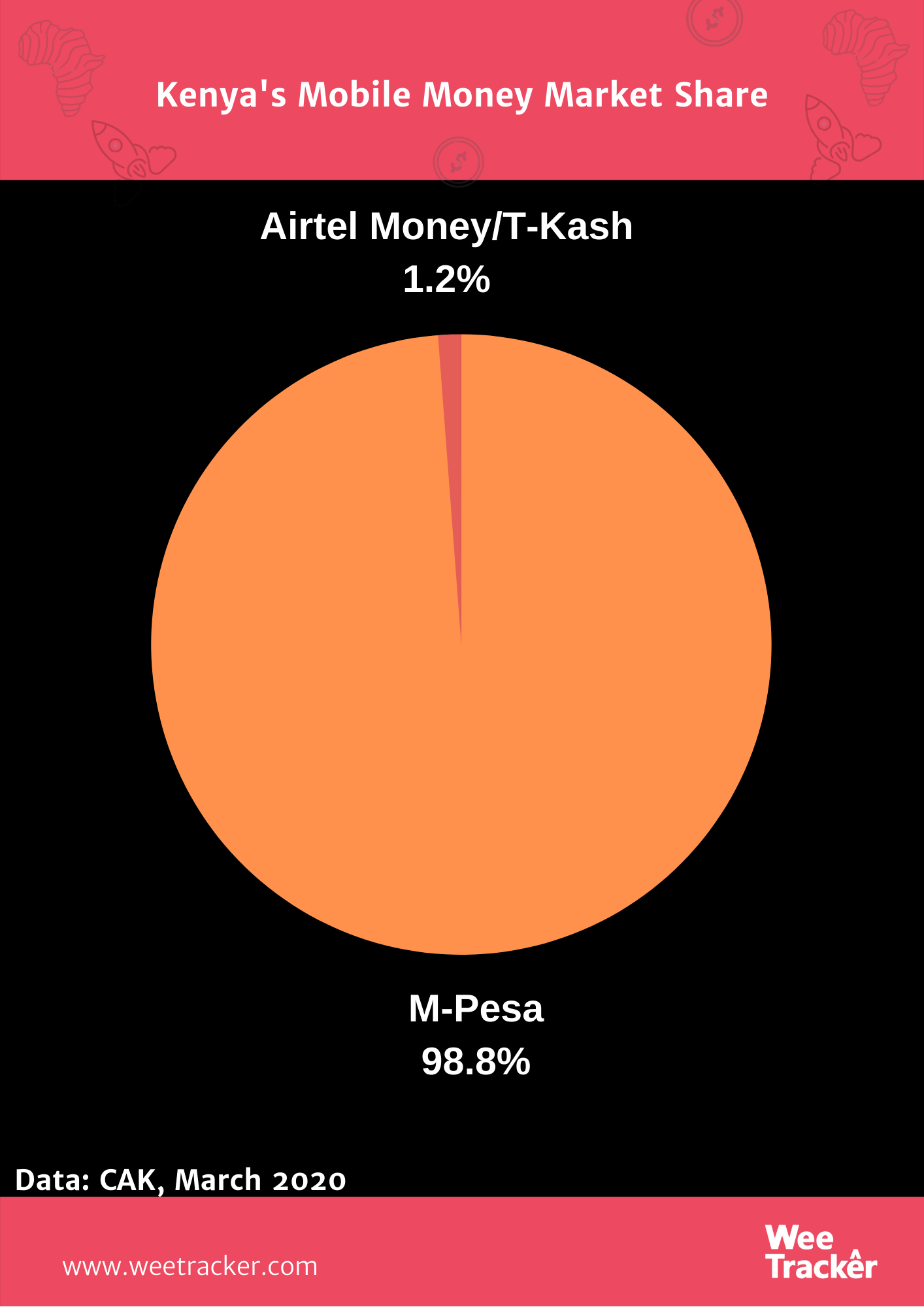

In mid-March, Kenya’s largest telco, Safaricom — which doubles as the country’s biggest mobile money operator by volume and value, controlling as much as 98 percent of the market share — announced a waiver on mobile money fees for transactions valued at KES 1 K (USD 9.32) or less. In line with the other emergency measures spelled out by the authorities, Safaricom increased the transaction limit for mobile money transactions on its overwhelmingly popular M-Pesa platform to KES 150 K (USD 1.39 K). Daily limit was set at KES 300 K (USD 2.79 K), as was the wallet limit.

Like Safaricom, another telco, Airtel Kenya, soon announced similar offerings. Commercial banks in Kenya also removed charges for customers moving money between their mobile wallets and bank accounts.

The result? A predictable significant rise in mobile money transaction value and volume, but not in the way that the service providers would have hoped.

As it is, Kenyans are gaming the system by keeping their transactions within the KES 1 K mark. In fact, some Kenyans are even splitting bulk sums into multiple smaller transactions so as to dodge the fees.

“Safaricom reported that customers were splitting high-value money transfers of as high as KES 60 K to deals of below KES 1 K, allowing them to enjoy a free service that ideally would have cost them KES 105.00,” Business Daily reported .

Indeed, when announcing the extension of the “mobile money freebie” to December 2020, the Central Bank of Kenya (CBK) did reveal that there had been a spike in low-value […]