Borrowings from Safaricom’s Fuliza hit Sh578 billion last year as ease of use and economic hardships pushed new users to the overdraft service. Latest disclosures by NBCA Group and KCB Group—the two banks that underwrite Fuliza overdrafts —show that the service has deepened its share in digital loans as customers get increased borrowing limits.

The overdrafts, utilised between January and December last year, translate to Sh1.58 billion daily borrowing, pointing to the increasing use of the service that was rolled out in 2019. Fuliza accounted for 82.5 per cent of the Sh585 billion digital loans at NCBA in the financial year ended December 2021.

A further Sh96 billion, or 60.8 per cent of Sh158 billion that KCB disbursed via mobile phones, was through Fuliza—a 32 per cent increase from Sh73 billion a year earlier.

“Increase (was) driven by limit enhancements for qualifying customers,” said KCB during the release of full-year results last week.

A rise in short term borrowings— mainly used to meet essential needs such as food, bus fare and rent—signals increased debt dependence following the huge loss of income witnessed in the economy after Covid-19 disruptions.

Safaricom said in November that an additional 700,000 customers had joined Fuliza in the six months to September to send the total number of daily active Fuliza users to 1.7 million.

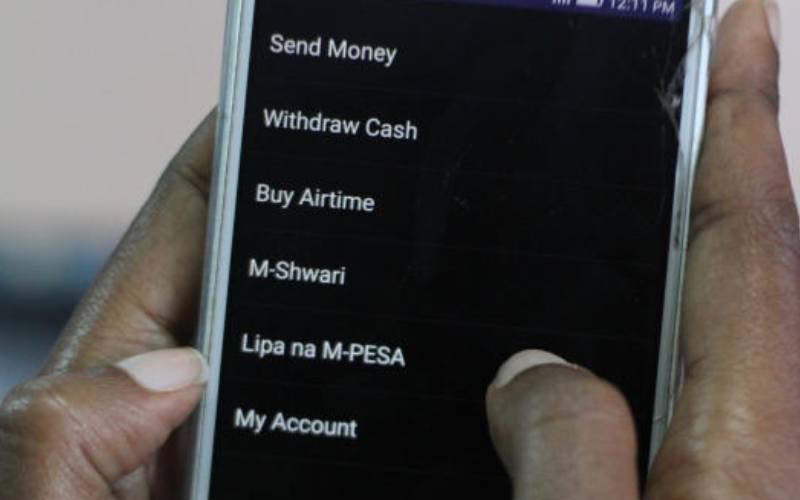

The telco introduced Fuliza service in 2019 and it has become popular among Kenyans in meeting essential needs such as shopping, rent and supporting friends and family when there is no sufficient money in their M-Pesa wallets.

It charges customers a one-off 1.083 per cent interest and a daily administrative fee that depends on the outstanding balance.

The Fuliza fee starts from Sh2 per day for Sh100 overdraft and goes up to Sh30 per day for Sh2,500 and above.

Customers who do not clear the overdraft within 30 days are barred from utilising their unused Fuliza limit until they settle the outstanding amount.

The default rate for Fuliza is usually very low since the debt is settled instantly when the customer’s M-Pesa wallet receives money.The rising popularity of Fuliza has come on the back KCB’s M-Pesa Vooma and NCBA’s Mshwari posting declines in value of loans.KCB-M-Pesa loans dropped by 26 per cent from Sh62 billion to Sh46 billion while Vooma loans moved from Sh19 billion to Sh16 billion.NCBA said it disbursed Sh88 billion via Mshwari, a product that was launched in January 2013 as a savings and loan service.Disclosures for […]