A digital mobile overdraft facility christened Fuliza , by Kenya’s biggest telco Safaricom Plc, is giving the country’s popular loan apps a run for their money barely three years after its launch.

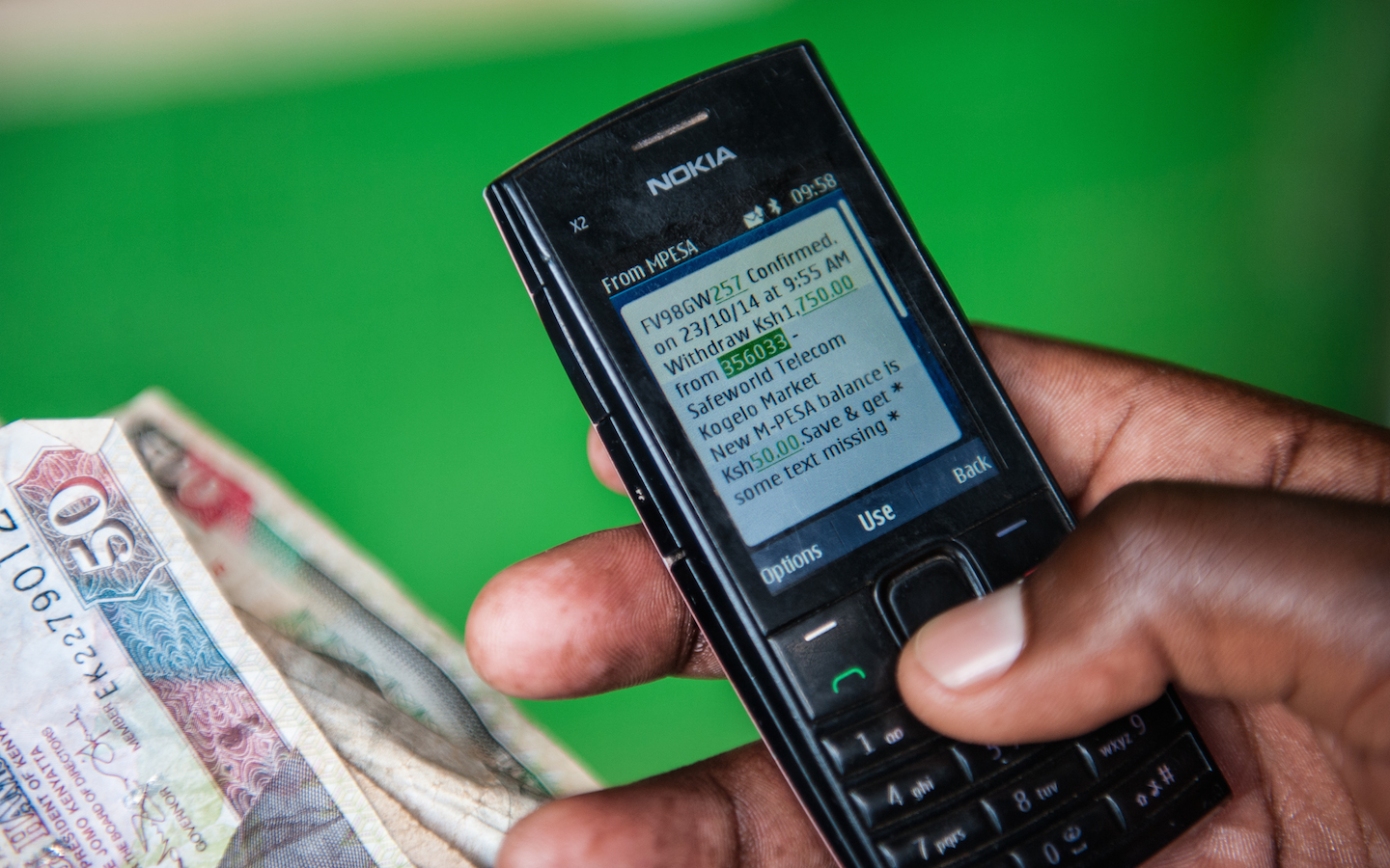

Fuliza allows Safaricom customers to access unsecured credit by overdrawing on M-Pesa – the telecommunication’s mobile money wallet that allows its users to pay bills, send, receive and withdraw money through their phones.

The uptake of Fuliza is currently at 18.3% across the country while that of loan apps decreased by 6.2 percentage points to 2.1% in the last two years, a study by the country’s monetary authority, Central Bank of Kenya (CBK) shows.

The latest bi-annual Finaccess Household Survey report said digital loan apps experienced the largest decline in usage when compared to other financial products and services by credit-unions, banks and microfinance institutions.

“This may be explained by competition from formal digital credit products like Fuliza, (and) unfair debt collection practices by the digital loan apps,” said the report.

The report also said that a directive by the CBK, barring unlicensed digital lenders from sharing the personal details of loan defaulters with credit reference bureaus (CRBs), may have deterred the apps from lending to customers viewed as risky.

Additionally, the uncertainty around the regulation of the apps by the CBK during the Covid-19 peak may have prevented them from extending credit to new borrowers. A bill on the regulation of digital lenders was tabled before Kenya’s legislative assembly and was just this month signed into a law .

The Digital Lenders Association of Kenya, which represents about 25 digital lenders out of the over 100 operating in Kenya, told TechCrunch in a past interview that its members generally give out loans worth $40 million every month, an amount that was, however, halved during Covid.

Fuliza, which is formally registered and licensed, operates in partnership with two local banks – KCB and NCBA. The product seems to have filled the mobile lending void obstructed by regulation, and has has now stepped-up competition for mobile loan apps like the Silicon-valley backed Branch, which launched in Kenya in 2015, and the pay-pal supported Tala, which set-up operations in the country in 2014 – one of the first digital lenders to enter the East African country.

According to a Safaricom report , the telco extended $3.1 billion in Fuliza credit during the 2020/21 financial year, a 43 percent increase from the previous year. This translates to an estimated […]