By Nqobile Dludla, Emma Rumney and Media Coulibaly

JOHANNESBURG/ABIDJAN (Reuters) – When COVID-19 hit Ivory Coast, Bonaventure Kra, who works at an import-export business, began to worry. Handling hard cash all day was a risk. Queuing in crowded bank branches exposed him to infection.

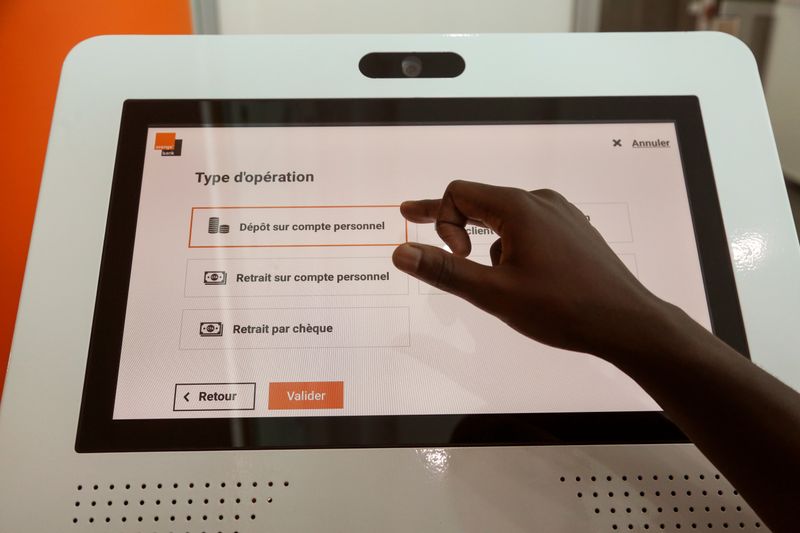

Then, in the midst of the pandemic, French telecommunications giant Orange launched an entirely digital bank – its first full banking venture in Africa.

"Going back to cash would be like travelling back in time," Kra said in the country’s commercial capital, Abidjan. "I intend to use it permanently."

Africa’s mobile phone operators are ramping up plans to bring banking to millions of Africans, in some cases for the first time, after the coronavirus crisis caused a surge in use of digital financial services.

Orange, MTN , Telkom and Vodacom are lowering fees, rolling out new lending services ahead of schedule, and expanding mobile payment networks with the aim of finally denting the so-far unshakeable dominance of cash.

"It’s one of those industries that we consider to be ripe for disruption," Sibusiso Ngwenya, financial services managing executive at South Africa’s Telkom, told Reuters.

With their revenue under threat as governments cap data prices and customers abandon voice phone services for free messaging apps, telcos have sought to leverage their reach into remote villages and urban shanty towns in a pivot to banking.

The global health crisis has been an unexpected catalyst, with some African governments releasing COVID-19 stimulus grants via mobile money platforms and central banks easing regulations, including limits on mobile transactions.

Orange added over five million new customers for its mobile money services in April and May alone. MTN hit one million South African users in June, when it had expected half of this, and recorded a 28% jump in mobile money transactions per minute across all its African markets in the first half of the year.

TAKING ON THE CASH KINGCash is still king in Africa.It accounts for around 99% of transactions in Nigeria, the continent’s most populous country, and dominates even in South Africa (90-95%) where banking penetration is relatively high, according to a 2017 estimate from consulting firm McKinsey.World Bank figures indicate just under 43% of sub-Saharan Africans over the age of 15 had a bank account in 2017. The region’s total population stood around 1.1 billion last year.That compared with 55% in Latin America and the Caribbean, almost 70% in South Asia and around 74% in East Asia and […]