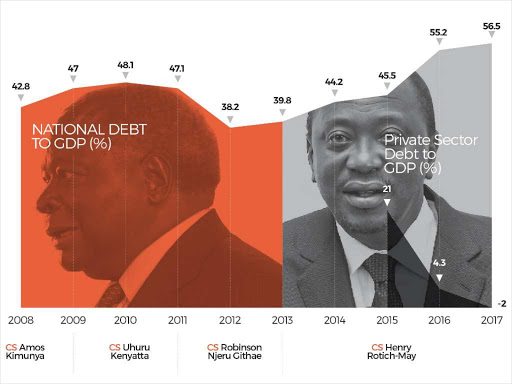

DEBT: Graph showing Kenya’s surging debt. Image: COURTESY While Kenyans are off resting over the Christmas break, National Treasury mandarins are burning the midnight oil, putting in play a final onslaught on public coffers.

The exchequer is going for broke as it desperately seeks to fill a yawning budget gap fuelled by corruption leaden legacy projects, rising fuel prices and a deteriorating trade balance.

An important rule of play in the dictator’s handbook is to change the rules of the game to your advantage.

In this case, the IMF has engineered a shift in the measurement of debt sustainability away from the debt ceiling to a GDP debt anchor.

However, the IMF and Treasury use data measures, which paint a rosier picture of Kenya’s economic wellbeing and are significantly removed from the real economy measures used by the Central Bank.

This is very much like the exploitation of constitutional amendments to presidential term limits, to extend the term of the incumbent. Moi did it in 1992, as have his counterparts in Burundi, Rwanda, and DRC.

Kenya’s public debt situation is made worse by the fact that the larger proportion of our debt is foreign. In an apparent about-turn, the IMF recently announced that Kenya would once again be borrowing on the Eurobond market.

Eurobonds have become a quick fix due to the relative ease of posting the bonds and the absence of checks and balances.

However, Eurobonds are costly and risky especially at this time when exports as a share of GDP have declined reducing Kenya’s foreign currency earning capacity.

African countries have been targeted by private capital seeking higher returns and secured on stringent lending terms, which are kept secret.

Underwriters of the Eurobond also include some local banks with high-level political connections, and so there is a perverse conflict of interest driving the appetite for Eurobonds.The final weapon in the administration’s binge borrowing strategy is the faulty narrative that Kenya has to borrow to finance infrastructure lead growth.This narrative overlooks the question of the prudence of the investments we are making and has resulted in investments without proven developmental impact or financial viability, many of which are subject to Auditor General queries.One dubious example of budgeted corruption is the annual bailouts to mismanaged state-owned enterprises.The 2019/20-audit report flags illegal outstanding obligations held by Kenya Airways (76B), Kenya Electricity Generating Company (43B), KPA (34B) all institutions, which are marred by allegations of conflict of interest and mismanagement.Going by […]