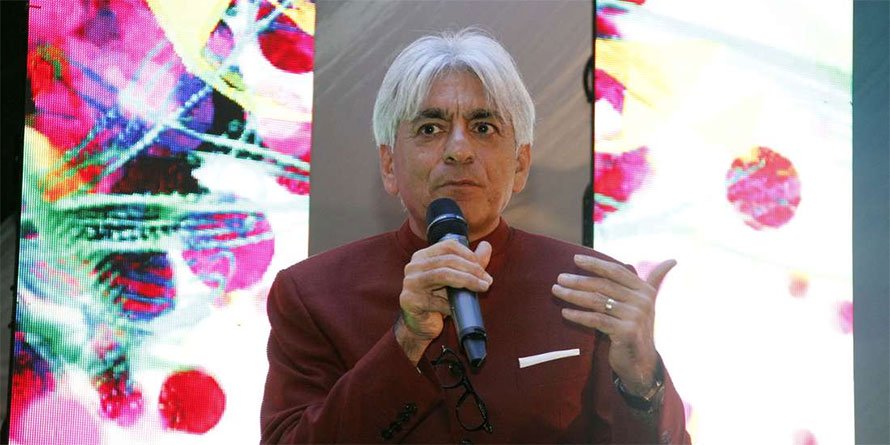

Scangroup CEO Bharat Thakrar during a past Africa marketing event in Nairobi.- DIANA NGILA Marketing services firm WPP Scangroup will pay a larger special dividend of Sh3.45 billion or Sh8 per share in August, the Nairobi Securities Exchange-listed firm has announced.

The company had earlier said it would distribute at least Sh2 billion or Sh4.7 per share from the proceeds arising from the sale of its Kantar business in Africa.

Scangroup has now decided to raise the dividend 70 percent to Sh8 per share or an aggregate of Sh3.45 billion.

“The board of WPP Scangroup Plc is pleased to announce the declaration and payment of a special interim dividend of Sh8 for every ordinary share held, subject to withholding tax, where applicable,” the company said in a market update.

“The special interim dividend will be payable to shareholders on the company register at the close of business on July 28, 2020. The dividend declared will be paid within 30 days from the closing date of the register.”

The payout represents a dividend yield of 45.7 percent based on the company’s share price of 17.5 on the Nairobi bourse yesterday.

Raising the dividend signals that Scangroup has excess cash at a time when the Covid-19 pandemic has slowed down capital expenditures and new acquisitions.

The company said its net proceeds from the Kantar deal stood at Sh5 billion. The transaction involved the sale of an 80 percent stake in Kantar TNS and a 100 percent shareholding in Kantar Millward Brown.

Profit-sharing

Scangroup could receive an additional Sh480 million from the disposal of its Kantar Africa stake.

The extra compensation is in the form of profit-sharing in the subsidiary for the period leading up to the conclusion of the transaction and payouts tied to the unit’s indebtedness.The disposal will reduce the company’s revenue and geographical diversification in the short term but will boost its cash pile.Scangroup’s net profit dropped 20 percent to Sh491.4 million in the year ended December 2019 compared to Sh612.2 million a year earlier.This was despite sales rising 13 percent to Sh5 billion from Sh4.5 billion.Scangroup said its bottom-line was hit by a mix of foreign exchange losses and reduced interest income on its cash holdings.