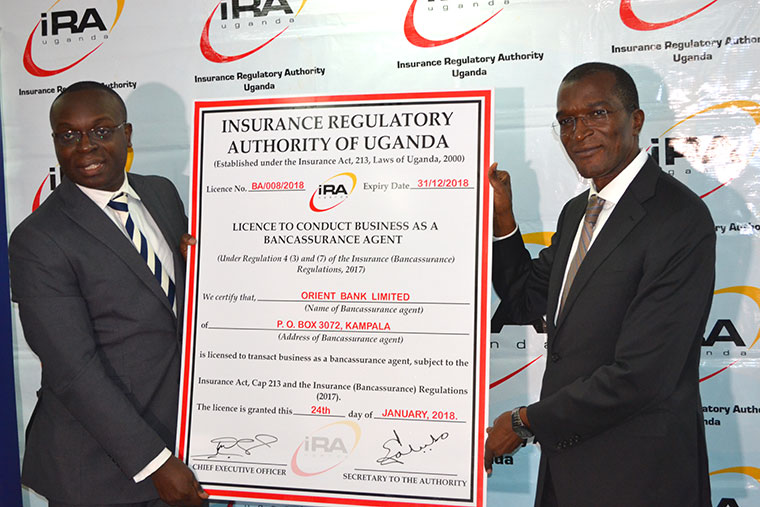

Orient Bank has become the eighth financial institution in Uganda to offer insurance policies to their customers and the public through Bancassurance after acquiring a license from Insurance Regulatory Authority (IRA) .

It joins dfcu, Barclays, NC bank, Diamond Trust bank, Stanbic, Bank of Africa and Finance Trust in this now seemingly attractive business.

This follows the amendment of the Financial Institutions Act 2016 to allow banks engage in insurance services.

Alhajji Ibrahim Lubega Kaddunnabbi, the chief executive officer of IRA, said if more banks can sell insurance products, it will increase insurance penetration, which currently stands at less than one per cent in Uganda.

“Bancassurance is one of the ways used for the distribution of insurance products through a bank’s branch network. As you are already aware, there is demand for simple insurance products in Uganda due to the huge and largely untapped emerging markets,” Kaddunnabbi said at the launch this week.

Kaddunnabbi believes using banks as insurers will instill confidence and trust in the public, subsequently attracting more people into the insurance fold.

Julius Kafeero, the managing director at Orient bank, explained that through collaboration with a range of local main insurance companies, Orient Bank will offer different varieties of insurance including in life assurance and general insurance.

“We are targeting to work with 11 insurance companies but for now we are starting with Sanlam Insurance (Life). We have also built in-house capacity and the bank will carry out training on the importance of insurance to its customers at every branch,” he said.

Bancassurance is the selling of insurance products through banks’ distribution channels. Banks leverage their extensive customer base and wide geographical spread and many branches.