World Bank senior economist for Uganda Richard Ancrum Walker says he is impressed with the public debate around proposed new taxes, including that on social media usage.

Addressing journalists in Kampala, Walker said that for long, public debate in Uganda has been about expenditures and not revenue mobilization. Walker said he is happy that this time, there has been a lot of public debate on the administration of revenues, which is crucial for Uganda.

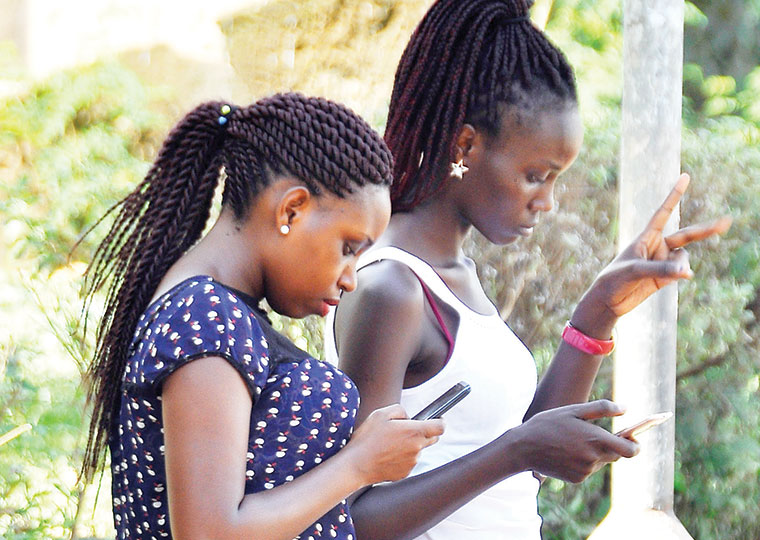

In the tax proposals for the financial year 2018/19, government intends to introduce new taxes including among others, the Shs 100 daily tax on social media usage, one percent charge on every mobile money transaction and taxing of savings and credit cooperative organisations (Saccos), among others.

Uganda Revenue Authority (URA) also wants banks to furnish it with customer details as one way of generating revenues, although the president has since halted the move. Also on the cards is a proposal to tax each international call at Shs 330.

The new tax proposals especially the ‘social media tax’ have generated public uproar, with most voices opposing it as "double taxation" on grounds that such social media users already pay taxes on the airtime and data, as well as on the smartphones.

In FY 2016/17, URA collected Shs 13 trillion which is less than half of the national budget of Shs 29 trillion. In order to cover the deficit, the government has to borrow externally and domestically, as well as sourcing from development partners.

The implication is that the borrowing increases the debt burden, as more and more monies are used to repay the debt, including more borrowing. In the current budget, nearly Shs 3 trillion is for debt repayment.

Reacting to the World Bank stance, political economist Prof Julius Kiiza, of Makerere University, agrees that the increased focus and debate on different sources and nature of government revenues is healthy and encouraging.

According to Prof Kiiza, the debate should be deepened to include government’s double standards of providing generous tax holidays for so-called investors, while, as he puts it, "squeezing the daylights out of ordinary businesses and citizens who are already struggling".Prof Kiiza says […]