Nigerian equities still have significant headroom for capital gains and are comparatively undervalued, but investors must be cautious as the market may be susceptible to cyclical reversal in 2022.

FSDH Capital, a major investment banking firm, in its latest equities coverage report obtained at the weekend, noted that while benchmark index for Nigerian equities currently shows considerable discounts to its five-year average and global frontier market peers, the outlook for Nigerian equities appeared more downbeat in 2022 than in recent years.

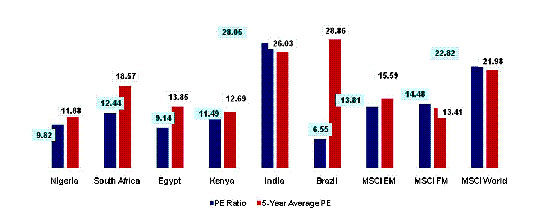

The benchmark market index, the All Share Index (ASI) of the Nigerian Exchange (NGX) trades at a PE ratio of 9.8 times, a 17.3 per cent discount to five-year average of 11.9 times. Similarly, the ASI trades at a 32.2 per cent discount to the MSCI Frontier Market (MSCI FM) index.

“Clearly, the market is undervalued considering the strong growth in company earnings in the past year as well as the additional listing of quality counters in the past 36 months.

“Despite the perceived value in the Nigerian market, we struggle to see a sustained rally in the equities market in 2022. First, we reckon that historically, the 40,000–45,000 points range represents a psychological barrier for investors and the index has not pushed past that level since 2008. Technically, we see this resistance level as a tough barrier for Nigerian equities to break in 2022.

“Also, while we expect to see modest improvement in economic growth in 2022, lack of stability in the foreign exchange market and an overvalued naira will continue to keep foreign investors away. For domestic investors, we expect them to be attracted to the fixed income market given expectation of a higher yield environment in 2022 which could fuel asset rotation from the equities market to fixed income assets,” FSDH stated.

The report however noted that there would be some bright spots in the equities market in 2022, although these may not be broad-based. FSDH advised investors to play actively in the equities market in this first quarter to exploit opportunities available particularly as companies release their full year numbers as well as announce attractive dividend yields.

It however cautioned investors to hold light exposures in the equities market in second and third quarters as it expects “the yield reversal and asset rotation to kick into full gear from the end of March”.

The investment pundit listed 10 companies as stocks to watch citing current price, lowest and highest prices in one […]